With Volusion right now, you can do the work and still feel like something is off.

Your SEO tool shows progress: more keywords, more pages indexed, and more signs that Google is picking you up. It looks like momentum. Then you open Analytics, and the story does not match. Sessions stay flat. Revenue does not move. After a while, that gap starts messing with your judgment, because you can prove activity, but you cannot prove impact.

This is one of the most common patterns heading into 2026 for Volusion stores: the keyword footprint expands, but traffic does not follow. The mistake is thinking visibility and traffic are the same thing. Visibility means you appear somewhere. Traffic only happens when you appear where people actually click.

So before you rewrite the blog, switch agencies, or blame the platform, ask one question that cuts through the noise: “Are your new keywords landing in the small band of positions that drive clicks, or are they stacking up in the part of Google that looks like exposure but behaves like invisibility?”

If you are seeing growth in the tools and silence in Analytics, you are not crazy. This is the pattern a lot of Volusion stores are walking into heading into 2026.

What the Data Shows Across Volusion in 2026

When you zoom out beyond a single store, the confusion becomes easier to explain.

If this was only happening to you, it would be simple to blame execution. Maybe your content is thin. Maybe competitors got stronger. Maybe your catalog changed. But when thousands of Volusion stores show the same shape, with keyword growth rising while traffic stays stuck, it stops being a “maybe” and starts being a platform pattern.

That pattern is clear in the platform-wide visibility data. Those numbers come from our platform-wide analysis, documented in the Volusion performance report. Across 3,666 Volusion domains, overall keyword visibility grew +28.49% year over year, while organic traffic stayed essentially flat at -0.8% YoY, a net drop of 57,393 sessions across the ecosystem.

Those numbers matter for one reason: the problem is not indexing; it’s where the rankings are landing.

If most of the new rankings are showing up outside the positions that earn clicks, you can “grow” in every SEO tool on the market and still feel dead in Analytics. The footprint gets wider, but the momentum never shows up, because the growth is happening in places buyers rarely reach.

That is the story Volusion stores are walking into in 2026: keyword growth is real, but ranking quality is not keeping up.

The Rankings That Matter Most Are the Ones Dropping

This is where most SEO reporting quietly misleads people.

Traffic does not come from “more keywords.” It comes from a very small set of positions. You can rank for thousands of terms and still feel invisible if most of those rankings sit just outside the click range. Page two might look close, but it behaves nothing like page one.

That is exactly what the Volusion data shows heading into 2026. While total keyword visibility is growing, the placements that actually produce clicks are shrinking. Top 3 rankings declined by 1.74%. Top 10 rankings dropped by 6.18%. And 59.1% of Volusion domains lost Top 10 visibility year over year.

Where growth actually matters:

- Top 3: consistent click volume

- Top 10: steady traffic engine

- 11–50: visibility that rarely converts into sessions

This is why the experience feels so disorienting in practice. Keyword growth can happen simply because Google indexes more pages, more variations, and more long-tail queries. You end up “ranking” for more terms, but many of those positions land between 11 and 50, where traffic is sparse and inconsistent. The chart looks healthier. The sessions do not move.

At the same time, losing even a small slice of the Top 10 rankings has an outsized impact. Those are the positions that bring buyers in steadily. So a store can expand its footprint and still lose the rankings that used to pay the bills. In the tools, the site looks bigger. In reality, it is weaker where it counts.

That is the real warning sign for Volusion merchants in 2026. The question is no longer whether your site can appear in search. It is whether you can hold, or regain, the narrow set of rankings that actually create momentum.

Why This Shows Up on Volusion More Often

Volusion is not blocking visibility, but it does make a certain kind of growth easier than another.

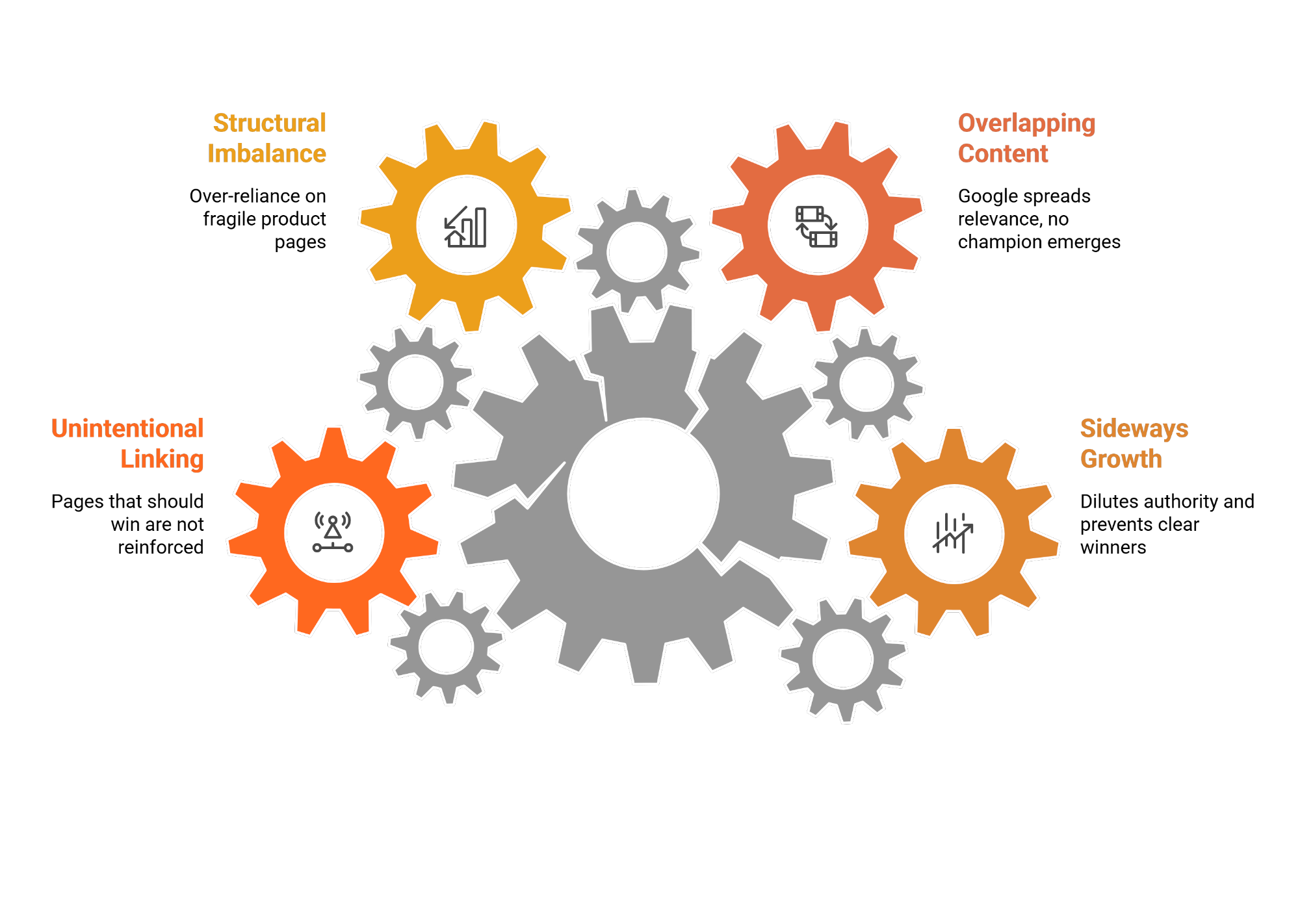

Many Volusion stores expand sideways instead of upward. Pages get added. Variations multiply. Similar paths coexist. Google indexes all of it, so keyword counts rise, but authority gets diluted. Nothing becomes the clear winner, which keeps rankings hovering in that “almost there” range.

Overlap is one of the biggest drivers. It is common to see multiple pages chasing the same intent, similar category paths, overlapping product groupings, or near-duplicate versions of the same page. Google does not choose a champion in that situation; it spreads relevance across all of them. The result looks like visibility growth, but the rankings stall where clicks do not happen.

There is also a structural imbalance in where strength gets built. Many Volusion stores rely heavily on product-level rankings. Product pages can rank, but they are fragile. Inventory changes, SKUs rotate, products go out of stock, and rankings disappear with them. Category pages are supposed to carry long-term momentum, but on many Volusion sites those pages are thin, underlinked, or treated like navigation instead of destinations.

Internal linking reinforces the problem. Not because Volusion cannot handle links, but because most stores never design them intentionally. Pages that should be winning do not get consistently reinforced, so they sit in the same positions month after month. Keyword counts grow. Ranking quality does not.

This is why so many Volusion merchants feel like they are doing SEO in place. The platform makes it easy to add more, but in 2026, adding more is rarely what turns rankings into traffic. Consolidation is.

The Split Reality: Winners vs. Everyone Else

What makes this pattern harder to accept is that Volusion does not decline evenly.

A small group of stores are still growing, and their data looks different in a very specific way. They are not just getting indexed for more terms; they are climbing into page one positions that earn clicks. Their keyword growth is concentrated where it matters, so traffic moves with it.

Most stores are living in the opposite reality. Some are gaining visibility only in low-impact positions that never turn into sessions. Others are losing ground in both directions, with fewer meaningful rankings and fewer visits. That split matters because it proves this is not random. It is not a seasonal dip or a single algorithm tremor. Structure and authority are starting to decide who compounds and who stalls.

The platform-wide data makes that divide clear. Only 7.9% of Volusion domains were “Dual Winners,” growing in both keyword footprint and organic traffic. Meanwhile, 38% were “Dual Losers,” declining in both.

If your store feels like it is running in place, this is why it feels so frustrating. You are not alone, and you are not misreading the signals. You are stuck in the middle zone where visibility exists. but competitiveness is slipping. Growth looks alive on the surface, but underneath, momentum is bleeding out.

What Volusion Merchants Should Check First

If you are stuck in this pattern, the worst reaction is to publish more content just to feel like you are doing something. It looks productive, but it often creates more pages that land in the same low-impact positions, then the traffic line stays flat, and you end up even more frustrated.

What you want first is a diagnosis that tells you where the disconnect is happening.

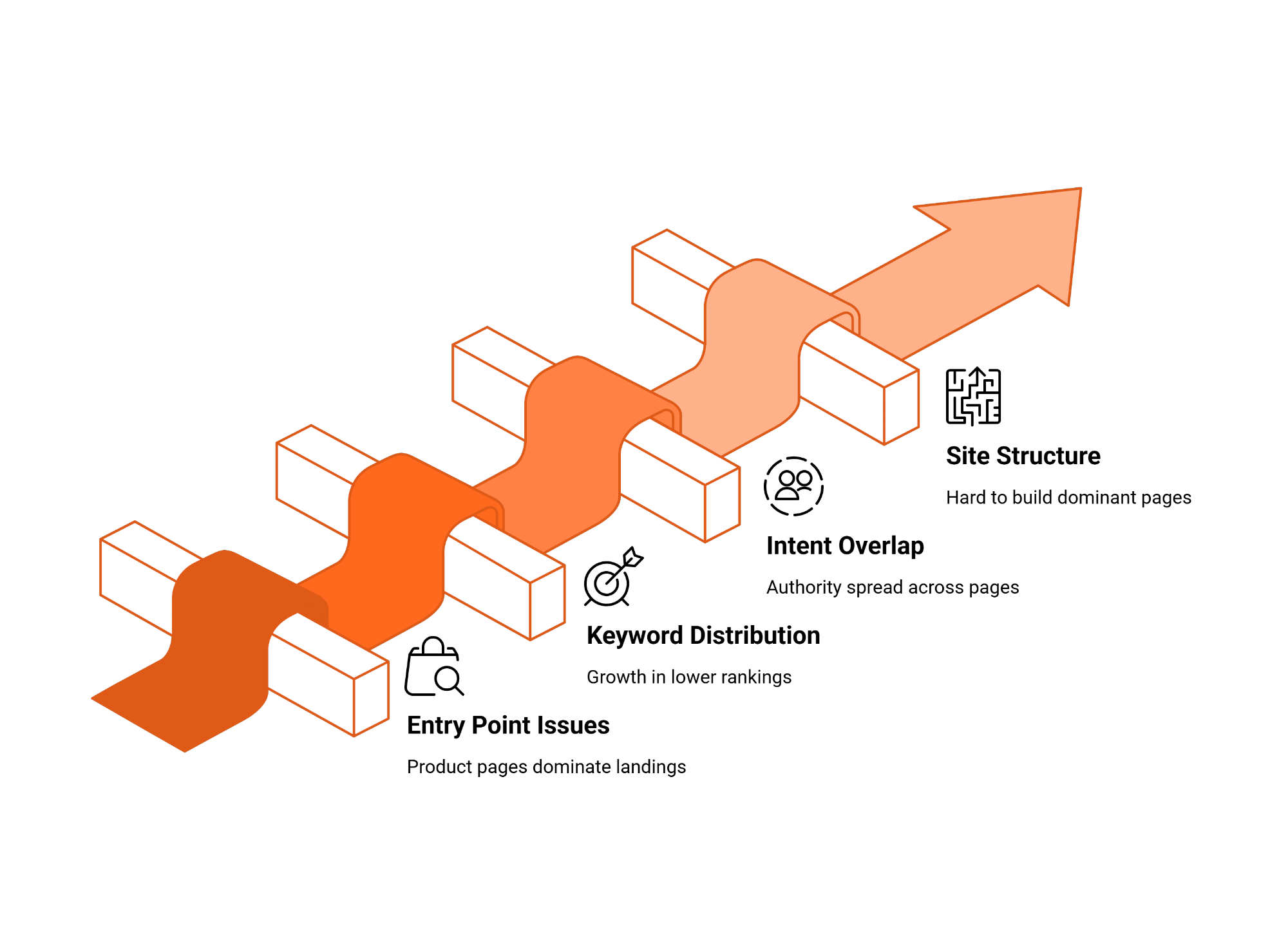

Start with your entry points. Look at what Google is actually sending people to. If most of your organic landings are product pages, and your category pages barely appear as entrances, that is a structural problem. Product pages can rank, but they are not stable assets. SKUs change, inventory disappears, pages get replaced, and the rankings disappear with them. Category pages are supposed to carry durable search traffic, but many Volusion stores never build them as true destinations.

Then look at where the “new keywords” live. If the growth is concentrated in positions 11 to 50, that alone explains why you feel nothing in Analytics. Those rankings inflate your keyword footprint, but they rarely translate into clicks. This is the zone where SEO reports look alive and the business feels unchanged.

Finally, check for intent overlap. If you have multiple pages that target the same buying intent, similar category groupings, near-duplicate collections, or overlapping paths, Google often spreads authority across all of them. You end up with more pages indexed, more keywords showing up in tools, and no single page strong enough to hold the Top 10.

These checks do not take long, but they tell you the truth fast: are you building pages that can actually climb, or are you accumulating rankings that never turn into traffic?

Once you see the distribution clearly, the next step stops being “do more SEO” and becomes a decision. If your growth lives mostly outside the Top 10, you are not dealing with a traffic problem; you are dealing with a climb problem. You already exist in the results. The job now is to concentrate authority so a smaller set of pages breaks into the range where clicks become consistent.

And if you have been doing the right work for months but your Top 10 footprint keeps shrinking anyway, that is when merchants start feeling the ceiling. Not because Volusion cannot rank; it can. The ceiling shows up when the site structure makes it easy to keep expanding but hard to build a few pages that dominate.

What Good SEO Looks Like on Volusion in 2026

If you want organic search to start behaving like growth again, the goal on Volusion is not to get indexed more. That part is already happening. The stores that break out in 2026 get disciplined about where they concentrate authority.

It starts with category pages, treated as true landing pages, not just a product grid. A category page that wins in 2026 has clear intent, enough context for Google to understand what it represents, and internal links that repeatedly signal, “This is the page that should rank.” When category pages carry weight, they become stable entry points that do not vanish the moment a product goes out of stock.

Then comes consolidation. A lot of Volusion stores accidentally create multiple pages that all deserve the same ranking. Google does not reward that; it splits the signals and keeps all of them average. The fix is choosing the page that should win, then reinforcing it with internal links, stronger on-page context, and removal of competing duplicates until it becomes the obvious answer for that intent.

The last piece is intent discipline. Keyword growth feels good because it increases the number in a tool. But the only keywords that matter are the ones tied to buying behavior. The stores that grow are not the ones ranking for more random long-tail variations. They are the ones winning high-intent terms with pages built to convert, not just to exist.

This is where many merchants make the wrong move. When traffic does not follow keyword growth, they add more surface area, more posts, more pages, and more “targets.” That usually spreads authority thinner. You end up with a bigger site that still cannot push the right pages into the Top 10.

The stores that recover tend to do the opposite. They pick fewer pages that deserve to win, usually category pages and the highest-intent collections, and they concentrate everything there: internal linking, content depth, cleanup of overlap, and structural reinforcement until rankings move into the click zone.

That is what good SEO looks like on Volusion in 2026: fewer targets, stronger pages, cleaner structure, and rankings that live where clicks actually happen.

What This Means If You’re Still on Volusion in 2026

If you are still running on Volusion in 2026, the takeaway is not that SEO is dead. It is that SEO has split into two different games, and most stores are playing the weaker one without realizing it.

It has become easier to accumulate rankings than to earn the rankings that actually move traffic. Accumulation looks like progress. Reports get prettier. Keyword counts climb. But if your Top 10 footprint is shrinking, or most of your “growth” is sitting outside page one, the work is not compounding. It is expanding. You are getting seen more often, but you are not getting chosen more often.

That is why Volusion keyword growth in 2026 is not what people think it is. The ecosystem is getting broader without getting stronger, and that is why so many stores feel stuck even when the tools show movement. If rankings are not consolidating into the Top 10, the traffic math never works out. You end up with more footprint and less traction, which is the most expensive kind of growth because it keeps you busy without paying you back.

If you want to know whether you are dealing with a fixable ranking quality problem or a real ceiling, contact us. We will review your keyword-to-traffic distribution, show you what is holding your Top 10 visibility back, and map out what to consolidate first so rankings start turning into traffic again.