The Hidden Risk of Migration

Every distributor eventually hits the wall with their e-commerce platform. What once felt adequate starts showing cracks as the business grows. Shift4Shop, once branded as 3DCart, has been that kind of platform for thousands of industrial distributors. It worked fine when the catalog was smaller, when workflows were simpler, and when digital was still a side channel. But growth has a way of exposing limits.

The conversation often starts in boardrooms the same way: “We need something more modern. Something that scales. Let’s migrate.” And the focus quickly turns to the obvious: moving products, categories, and content. But what doesn’t get enough attention until it’s almost too late are the invisible threads holding customer relationships together: contract pricing, customer-specific catalogs, and saved bulk order templates.

For a B2B distributor, those aren’t nice extras. They are the very fabric of how institutional buyers work with you. A procurement officer logging in expects to see their pricing, not a generic retail rate. They expect the catalog they’ve always seen streamlined to only the SKUs they’re authorized to purchase. They expect their saved order templates for the 120 SKUs they reorder every month. If those things vanish during a migration, you don’t just risk a complaint, you risk a contract.

This is the hidden danger in platform moves. It’s not about whether the new site looks better or loads faster. It’s about whether your best customers feel any friction in the one thing that matters most: ordering what they need, when they need it, without disruption. Break that trust once, and the millions of dollars tied up in long-term agreements can vanish overnight.

That’s why this article isn’t just about “moving off Shift4Shop.” It’s about how to do it without breaking the contracts and workflows that keep your revenue flowing. BigCommerce Enterprise offers the scalability and modern infrastructure distributors need, but getting there safely requires more than a lift-and-shift. It requires a strategy designed to protect every pricing tier, every catalog, and every bulk template so that your customers barely notice a change.

Why Distributors Outgrow 3DCart / Shift4Shop

Most distributors don’t wake up one morning and decide to rip out their e-commerce system for fun. They migrate because they’ve been living with growing pain for years, and Shift4Shop (or 3DCart, as many still remember it) just can’t keep up.

On the surface, it’s a platform built to do the basics. You can load products, process orders, and run a storefront. But when you move into mid-market and enterprise distribution—where contracts, negotiated pricing, and bulk reorders define the business—the cracks become impossible to ignore.

Scalability is usually the first red flag. Adding new product lines or managing tens of thousands of SKUs becomes a chore instead of a growth opportunity. Pages slow down, catalogs feel clunky, and the site that once worked for a smaller catalog simply doesn’t hold under enterprise weight.

Then comes pricing. Shift4Shop supports basic pricing tiers, but it lacks the sophistication and scalability required for enterprise-level contracts—things like multiple tiers across different accounts or unique negotiated terms per contract. For B2B distributors, this isn’t optional; it’s the foundation of the business model. When a buyer logs in and doesn’t see the exact rate they negotiated, the system isn’t just inconvenient—it feels broken.

Catalog control is another gap. Many distributors rely on segmented catalogs, where each institutional buyer only sees the SKUs relevant to them. Shift4Shop provides some catalog segmentation through customer groups, but it lacks the precision and account-level granularity enterprise buyers demand.

Bulk ordering is where the cracks really show. Procurement teams don’t shop like consumers browsing a cart on a weekend—they work off saved templates, repeat lists, and need to drop in dozens of SKUs at a time. Shift4Shop includes basic tools like CSV uploads and reorder lists, but in practice they’re clunky, outdated, and not built for enterprise-scale workflows. They might be fine for a smaller account placing the occasional bulk order. But for enterprise buyers with complex contracts and repeatable workflows, they become a real liability.

At a certain scale, these gaps stop being annoyances and start being liabilities. Distributors realize they’re burning time on workarounds, forcing their teams into manual fixes, and risking the very contracts that keep the business alive. That’s the moment when migration stops being a nice idea and becomes a business necessity.

What’s at Stake: The Real Cost of Losing B2B Functionality

When consumer brands replatform, the risks are mostly cosmetic. Maybe a few broken links, maybe a hit to SEO, maybe some frustrated shoppers who can’t find the new checkout button. For B2B distributors, the stakes are much higher. Here, every function lost in migration has a direct line to revenue and often to legally binding agreements.

Contract pricing isn’t just a number in a database. It’s a negotiated commitment. If a procurement officer logs in after a migration and sees retail pricing instead of their contracted rate, it’s more than an inconvenience; it feels like a breach of trust. At best, they call your sales rep demanding answers. At worst, they freeze orders and start shopping your competitors. Either way, the damage is done.

Customer-specific catalogs carry similar weight. Many institutional buyers don’t want or aren’t even allowed to see products outside their contract. If your migration strips away that filtering, the result is chaos. Buyers waste time, procurement processes grind to a halt, and suddenly your digital channel, which was supposed to simplify ordering, is making their jobs harder.

Then there are bulk order templates. These aren’t small conveniences; they’re essential to how procurement teams work. A university lab ordering 200 SKUs every quarter doesn’t want to build that cart from scratch each time. They rely on saved lists, templates, and reorders to cut through complexity. Take that away during migration, and you’re not just slowing them down—you’re adding hours of administrative work to an already burdened team. And procurement officers have long memories. Once you’ve cost them time, they’ll look for a partner who won’t.

What’s at stake isn’t a few lost orders—it’s long-term contracts, recurring revenue, and relationships that took years to build. A single failed migration can put millions of dollars at risk, not because your products aren’t good, but because the systems buyers depend on stopped working the way they expected.

That’s why you shouldn’t underestimate this process.You’re not just moving SKUs and pages. You’re moving the very infrastructure of trust between you and your customers. Break it once, and you may never get it back.

Why BigCommerce Enterprise Is the Right Destination

When distributors finally admit Shift4Shop isn’t built for the scale they’ve reached, the obvious question is, where do we go instead? Not every platform can handle the complexity of B2B contracts, and too many “consumer-first” solutions collapse under the weight of negotiated pricing and bulk workflows. This is where BigCommerce Enterprise sets itself apart.

At its core, BigCommerce was designed with flexibility in mind. It isn’t locked into rigid templates that force every customer into the same mold. Instead, it comes with a B2B Edition layered directly into its enterprise offering—giving distributors native support for the very features Shift4Shop struggles with.

Contract pricing is no longer a headache. BigCommerce’s price lists and customer groups make it possible to honor tiered pricing structures across hundreds of accounts without relying on hacks or custom patches. Each buyer logs in and sees exactly the rates they negotiated—no confusion, no manual overrides.

Customer-specific catalogs are built into the platform’s DNA. Instead of showing every SKU to every buyer, you can segment catalogs by account, contract, or purchasing role. That means procurement teams only see what they’re authorized to buy, and your team gains tighter control over who gets access to what.

Bulk order workflows, often the Achilles’ heel of older platforms, are supported in BigCommerce Enterprise through its B2B Edition and can be extended further with APIs. Buyers can save lists, reorder in bulk, and even assign purchasing roles within their company accounts. With reorder lists, quick order tools, and the option to preserve saved templates via custom scripts, the platform is designed to mirror how enterprise procurement teams actually operate—not how consumers shop.

Scalability rounds out the case. Unlike Shift4Shop,, BigCommerce is built to grow. Whether you’re adding tens of thousands of SKUs, spinning up regional storefronts, or integrating directly into ERP and CRM systems, the infrastructure can handle it.

For mid-market and enterprise distributors, this combination matters. It’s not about bells and whistles—it’s about stability, trust, and future-proofing. BigCommerce doesn’t just keep you from breaking contracts during migration. It gives you full support and flexibility.

The Migration Minefield: Where Most Projects Fail

Every distributor knows migration carries risk. But too often, projects stumble not because the new platform is wrong, but because the move itself was mishandled. Teams treat it like a simple catalog migration—export products from Shift4Shop, import them into BigCommerce, and call it a day. On paper, that looks efficient. In practice, it’s a recipe for broken contracts and angry buyers.

The most common mistake is underestimating the complexity of contract data. Pricing tiers, discount schedules, and catalog rules—these aren’t clean, single-column spreadsheets you can copy and paste. They’re layered, negotiated structures that often evolved over years. When migration teams try to “simplify” that data to fit it neatly into the new platform, details get lost. Those missing details show up later as pricing errors buyers notice instantly.

Another pitfall is overlooking buyer workflows. Saved order templates, purchase lists, and reordering habits—these aren’t tracked in a neat database column. They’re embedded in how customers interact with your platform day after day. If no one maps them before migration, they vanish, leaving procurement teams starting from scratch. To them, it doesn’t feel like an upgrade. It feels like a disruption.

Timing is another failure point. Migrations that happen too quickly, without staged testing, create a nightmare scenario: the new site goes live, customers log in, and discover the system doesn’t behave as expected. Calls flood your sales reps. Orders stall. Trust evaporates. All because no one ran the migration through a pilot group of key accounts before flipping the switch.

And then there’s the human side. Internal teams often aren’t trained on the new platform until after go-live. That leaves sales and support scrambling to answer questions they don’t understand, which only compounds customer frustration.

The lesson is clear: most failed migrations don’t fail on technology, they fail on process. They fail because distributors forget that what they’re moving isn’t just products and pages. They’re moving relationships, contracts, and trust.

The Structured Migration Path: Preserving Contracts, Pricing, and Workflows

A successful migration is the result of a deliberate process that treats customer relationships as the most valuable asset being moved. The goal isn’t simply to get data into BigCommerce—it’s to make sure buyers log in the next day and feel nothing has changed, except maybe that the site is faster and easier to use. That requires a structured path.

The first step is inventory. Before a single line of data is touched, every contract agreement, pricing tier, catalog rule, and bulk order template needs to be cataloged. This isn’t just about technical accuracy—it’s about surfacing all the hidden agreements and workflows that sales reps and customers have been relying on for years. Too often, companies discover “orphaned” contracts mid-migration because they weren’t properly documented. A thorough audit prevents that.

Once inventory is complete, mapping begins. Shift4Shop data structures rarely align neatly with BigCommerce’s B2B Suite. That’s why the migration team must translate—not just copy—the data. Pricing tables become price lists. Customer groups become segmented accounts. Saved order templates may need to be rebuilt or ported via custom scripts. This mapping ensures the functionality carries over in a form the new platform can sustain long-term.

Customization is the third layer. Even with BigCommerce’s strong B2B foundation, every distributor has unique needs. Maybe a large buyer uses purchase approvals, or a contract requires minimum order thresholds. This is where APIs or middleware integrations come into play. Instead of forcing the customer to adapt to the new platform, the platform adapts to the customer’s expectations.

Validation is the step too many skip. Before going live, key accounts must be walked through the new system with their actual contracts and workflows in place. If a Fortune 500 client’s buyer can log in, place their usual bulk order, and see their correct pricing before launch, you’ve just eliminated the single biggest risk of migration: surprise on day one.

Finally, training closes the loop. Internal teams—sales reps, customer service, and operations—must know how to support buyers in the new system from the moment it launches. If a procurement officer calls confused, your team can’t afford to say, “We’re still figuring that out.” Training ensures continuity on both sides of the relationship.

A rushed migration might check boxes faster, but it leaves contracts vulnerable. A structured migration moves carefully, ensuring that when the switch is flipped, buyers keep ordering without missing a beat—and your revenue stream remains intact.

Technical Blueprint: How It Actually Works in BigCommerce

Contract Pricing

Shift4Shop often stores discounts and negotiated rates in messy, overlapping tables. BigCommerce simplifies this with price lists tied to customer groups. Each buyer logs in and sees the exact rates they negotiated, whether that’s a percentage discount or a flat contract price. No guesswork, no manual overrides.

Customer-Specific Catalogs

Instead of giving every buyer visibility into your full catalog, BigCommerce uses segmentation rules to control access. A hospital group might see only the 300 medical SKUs relevant to them, while a government buyer sees a completely different subset. From the buyer’s perspective, the catalog feels like it was built just for them.

Bulk Order Templates

For procurement teams, saved lists and reorders aren’t conveniences—they’re survival tools. With BigCommerce Enterprise’s B2B Edition, bulk order templates and reordering workflows come built in. Core BigCommerce can achieve the same outcome through APIs or custom scripting. During migration, the key is carrying over the templates customers built in Shift4Shop—using scripts to move those patterns into reorder lists so buyers log in and find their familiar workflows intact.

Integration: The Glue Holding It All Together

Distributors don’t manage e-commerce on their own—it has to work hand in hand with ERP, CRM, and punchout catalogs. BigCommerce’s API-first architecture makes sure contract terms, inventory data, and order statuses flow effortlessly between systems. That seamless integration builds trust with enterprise customers, giving them confidence that their contracts and commitments are always being met.

Beyond Preservation: Unlocking New Opportunities

Preserving contract terms and workflows is the baseline. It’s what you have to do just to keep revenue flowing. But the real value of moving from Shift4Shop to BigCommerce Enterprise isn’t that nothing breaks—it’s that you suddenly have room to grow in ways the old platform never allowed.

Once the contracts and pricing rules are safely in place, distributors find themselves standing on a sturdier foundation. That’s when new opportunities begin to open up. Multi-storefronts, for example, let you spin up different sites for different regions, contract groups, or even entirely separate brands—all managed from a single BigCommerce backend. For companies managing complex buyer networks, this changes the game: one platform, many tailored experiences.

Procurement teams also gain more autonomy. With BigCommerce’s B2B Edition, buyers can set up their own sub-accounts, assign roles, and approve purchases internally. What used to require constant coordination with your sales reps now happens inside the portal, cutting delays and freeing your team to focus on higher-value work. Instead of calling in to confirm a purchase, the buyer just logs in, uses their contract pricing, and checks out.

There’s also the ability to layer in new tools—real-time quoting, advanced shipping calculators, and even predictive analytics integrations for reordering. Shift4Shop made most of those either impossible or painfully custom. BigCommerce, with its API-first framework, makes these integrations practical.

The biggest shift, though, is perception. When your largest buyers see you offering the same seamless, modern digital experience they’re getting from billion-dollar suppliers, it signals something bigger than convenience. It tells them you’re investing in the relationship, not just fulfilling the contract. That kind of trust and credibility is hard to buy—but it’s easy to lose if your platform feels outdated or fragile.

A structured migration protects the status quo. A well-executed migration, however, creates a springboard. It gives you the confidence that existing customers won’t leave—and the flexibility to expand into markets and accounts you couldn’t have touched before.

Measuring Success After Migration

When the switch flips and your new BigCommerce site goes live, the first thing most distributors feel is relief. The site loads, the catalog is there, and the orders are flowing, or so it seems. But in B2B, you can’t stop at “nobody’s complaining yet.” The real measure of success is whether your biggest customers are still behaving exactly as they did before because even small cracks in the experience can ripple into million-dollar problems.

The first number to watch is repeat orders. If your institutional buyers keep ordering on the same schedule, in the same quantities, you’ve passed the most important test. But if you notice a slowdown—orders delayed, values dropping—that’s not a seasonal dip. That’s a red flag. It usually means something broke in translation: a contract price didn’t map correctly, an SKU disappeared, or a saved template never made the jump.

You’ll also know you’re in trouble if your sales team suddenly turns into a help desk. After a bad migration, the first month is chaos, with endless calls about “my price is wrong” or “I can’t find my usual catalog.” Those aren’t small annoyances. They’re signals that trust is slipping. A clean migration, on the other hand, feels almost eerie: no disputes, no arguments, just business as usual. That silence isn’t boring—it’s gold.

Pay attention, too, to how procurement officers behave. If they log in, place their bulk orders, and never pick up the phone, it means you preserved their workflows. Procurement people are creatures of habit. They don’t explore new systems for fun. If they’re comfortable enough to just keep going, you’ve done your job right.

Then there are the signs that you’ve not only preserved but also improved. Maybe onboarding new accounts suddenly feels faster because segmentation rules are clearer. Maybe orders tick upward because the site is smoother to use. Maybe average order values creep higher because buyers are seeing more of your catalog without the old friction slowing them down. Those aren’t accidents; they’re signals that the migration didn’t just protect revenue, it set the stage for growth.

At the end of the day, success isn’t measured in flashy numbers or launch-day applause. It’s measured in continuity. If your customers barely notice you switched platforms, you’ve done it right. And if, on top of that, they start ordering more often and with fewer headaches, you’ve done more than migrate—you’ve earned their long-term trust.

The Competitive Advantage of a Smooth Migration

Most distributors approach a platform migration with one goal: don’t lose what we already have. And that’s fair—preserving contract pricing and workflows is the lifeline of the business. But here’s the overlooked reality: very few companies actually pull it off cleanly. Which means if you do, you’re not just keeping pace; you’re pulling ahead.

Think about what usually happens in this industry. A distributor replatforms, the site goes live, and suddenly their largest accounts are calling about broken pricing or missing catalogs. Orders stall, relationships fray, and competitors circle. Buyers don’t care that you “upgraded.” They care that they can’t place the order they’ve been placing for five years. And when trust is shaken, it doesn’t take long for another distributor to slip in and offer a smoother experience.

Now flip the script. Imagine your buyers logging in the morning after migration, expecting headaches, only to find everything exactly as it should be—their pricing, their catalogs, their order templates—all intact. To them, it feels seamless. To you, it’s a competitive weapon. Because while your competitors are stumbling through disrupted relationships, you’ve proven to your customers that you can innovate without creating friction.

That kind of execution builds credibility. Procurement officers talk. Word spreads that your digital channel is reliable, modern, and trustworthy. New accounts notice too. In an industry where reputation travels faster than marketing campaigns, being the distributor that didn’t screw up the migration becomes a selling point in itself.

And the edge doesn’t stop there. Once you’ve protected the base, you can actually use BigCommerce’s capabilities to outpace slower-moving competitors: multi-storefronts for regional buyers, self-service portals that reduce rep dependency, and integrated quoting that speeds up deals. Competitors stuck patching holes in their migrations are too busy cleaning up to focus on growth.

In B2B, the competitive advantage isn’t always flashy. Sometimes it’s as simple as continuity. If your customers can keep ordering without missing a beat—and you layer on new capabilities while competitors stumble—you’ve just carved out a position they’ll struggle to match.

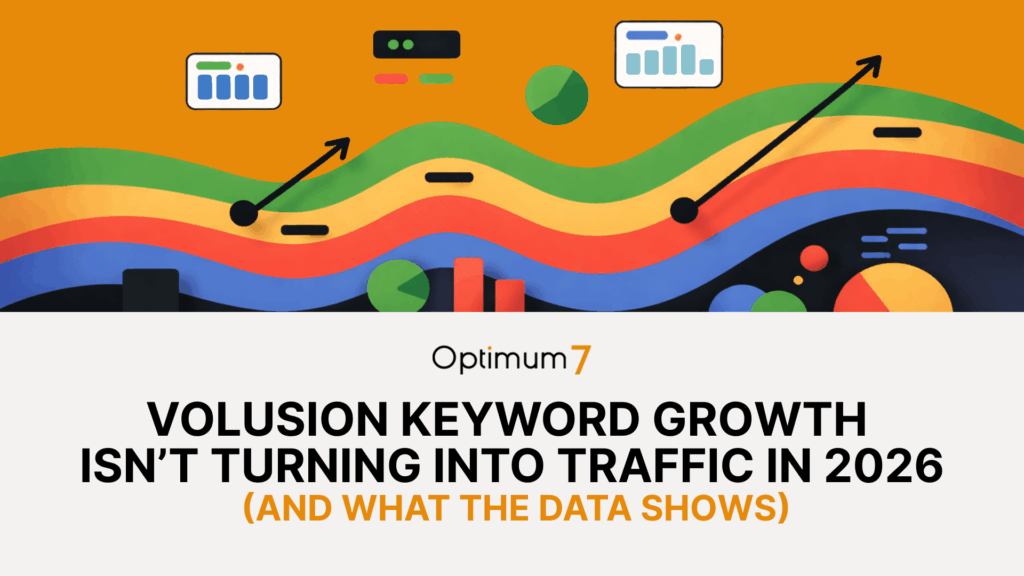

Shift4Shop → BigCommerce Migration Toolkit

For Industrial Distributors Protecting Contracts, Catalogs, and Bulk Orders

Pre-Migration Risk Checklist

Use this to verify you’re ready to begin migration. Mark each as Complete / In Progress / At Risk.

| Risk Area | What to Verify Before Migration | Status |

| Contract Pricing | All account-specific pricing tiers, discounts, and schedules documented | |

| Customer Catalogs | SKUs segmented by account and contract rules, not just by groups | |

| Bulk Order Templates | Exported buyer order lists, reorders, saved carts, templates | |

| ERP / CRM Integration | Workflows between contracts, pricing, and fulfillment mapped | |

| Pilot Accounts | 3–5 strategic accounts identified for migration testing |

Platform Comparison Table

Clarify what you’re leaving behind versus what you gain with BigCommerce.

| Functionality | Shift4Shop (3DCart) | BigCommerce Enterprise | Migration Priority |

| Contract Pricing | Basic tiers, limited scalability | Price lists and account-level precision | Critical |

| Customer Catalogs | Broad groups, weak segmentation | Segmentation by account, contract, or role | Critical |

| Bulk Ordering | CSV uploads, clunky lists | Saved templates, reorder tools, APIs | Critical |

| Scalability | Struggles with 10k+ SKUs | Enterprise-grade scalability, multi-storefronts | High |

| Integration | Patchwork APIs | API-first, ERP and CRM ready | High |

Migration Scorecard

Rate each item on a scale of 1–5 (1 = broken, 5 = flawless). Use pre-migration as a baseline, post-migration as proof of success.

| Category | Pre-Migration Target | Post-Migration Goal | Score (1–5) |

| Contract Pricing Accuracy | 100% mapped | 100% preserved | |

| Catalog Segmentation | Correct SKUs per account | No cross-account leakage | |

| Bulk Order Templates | All templates exported | Reorder workflows intact | |

| ERP/CRM Sync | No lag/errors | Real-time updates | |

| Procurement Continuity | Buyers reorder without calling sales | Silence from buyers = success |

Protecting Contracts While Moving Forward

Replatforming is inevitable. Platforms like Shift4Shop weren’t built to carry the weight of enterprise distribution, and every year you wait, the cracks get deeper. But migration isn’t just a technical exercise—it’s a relationship test. If your customers lose their pricing, their catalogs, or their workflows, the damage can’t be undone.

The good news: it doesn’t have to be that way. With a structured migration into BigCommerce Enterprise, every contract term, every pricing tier, and every bulk order template can come with you. From your customer’s perspective, nothing changes—except that the site feels faster, easier, and more modern. From your perspective, you’ve preserved millions in revenue and opened the door to new growth opportunities.

The companies that treat migration as a checklist risk losing accounts. The ones that treat it as contract preservation build an advantage their competitors can’t match.

If you’re planning to move off Shift4Shop, don’t gamble with the relationships that keep your business alive. Contact us, and we’ll map every risk point in your current system, show you exactly how to protect your accounts in BigCommerce, and give you a clear path forward—so when you flip the switch, your customers don’t even flinch.

Because in B2B, the measure of a successful migration isn’t a new website. It’s a customer who doesn’t notice a thing—except how much easier you just made their job.