AI Is Reshaping How People Discover Businesses, and Most Brands Are Not Ready

People are no longer opening a browser to compare options. They are asking ChatGPT, Claude, and Gemini for recommendations. A single question like “Who should I use for bookkeeping in Florida” or “What is the best fulfillment partner for Shopify stores” now shapes the first stage of real buying decisions. The businesses that appear in those answers enter the consideration set immediately. The ones that do not are invisible, even if they rank well in search or have strong social proof.

This shift is not theoretical. OpenAI’s State of Enterprise AI 2025 report shows how quickly behavior is changing, with buyers at every level turning to AI systems as their first source of recommendations, research, and decision validation.

This speed of adoption has created a visibility gap that most businesses never check, because there has never been a way to measure it. Owners assume that if their website is optimized and their reviews are strong, AI will naturally understand their value. That is rarely what happens. AI systems blend data from many sources, weigh credibility differently than search engines, and often fill in gaps with assumptions. The result is simple: many businesses are never mentioned, mentioned inaccurately, or overshadowed by competitors who understood how AI interprets their category.

The gap is not about traffic or keywords; it is about presence. When a buyer asks for recommendations, AI does not show ten pages of results. It gives a shortlist. If your business is not in that shortlist, the buyer never knows you were an option. This is the new discovery funnel: faster, narrower, and far less forgiving.

Understanding how AI sees your business is no longer optional. It determines whether you show up in the conversations that guide real decisions.

People assume being “present” online is the same as being understood by AI, but visibility is only half of the picture. How you are framed matters just as much. A business may appear in an AI-generated recommendation yet be described with outdated details, incomplete services, or generic language that weakens its positioning. These systems often rely on patterns formed from old listings, scattered third-party data, or simplified summaries, and those signals shape how buyers interpret your value long before they ever reach your website.

This is why the AI visibility gap is deeper than most businesses realize. It is not just whether you show up; it is what version of your brand AI is presenting on your behalf. Replacing assumptions with a measurable baseline becomes the first real step toward fixing that narrative across the questions real buyers are already asking.

Turning AI Into a Measurable Channel With the GEO Testing Platform

Once a business understands that AI visibility can be measured, the next question is how to measure it in a structured and reliable way. The GEO Testing Platform exists for that purpose. It takes the scattered, unpredictable nature of AI-generated answers and turns it into organized data you can use.

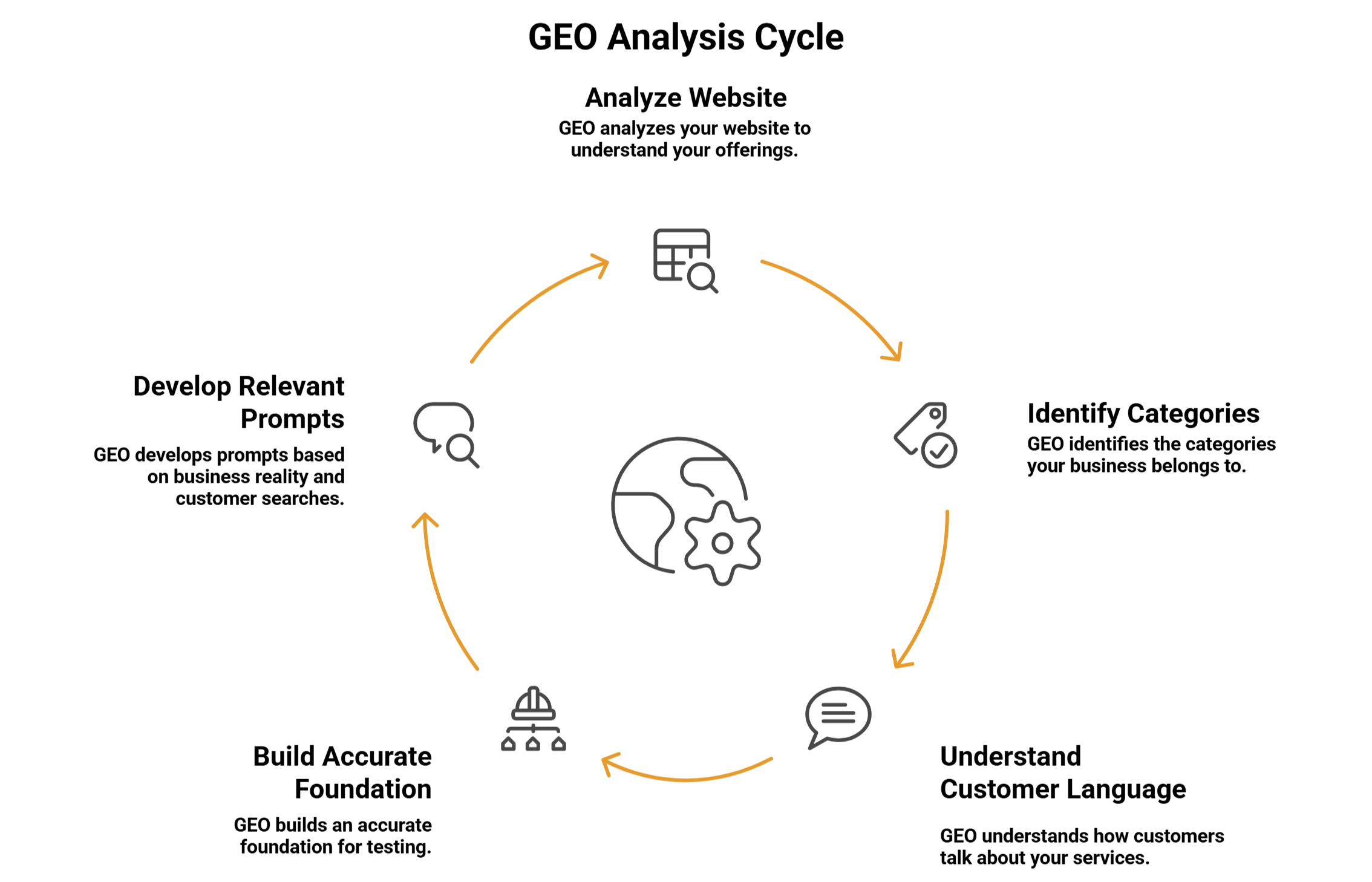

The process begins with your domain. GEO analyzes your website to understand what you offer, which categories you belong to, and how buyers typically talk about your services. This creates an accurate foundation before any testing starts. The platform does not guess which prompts matter; it builds them around the reality of your business and the way customers search for solutions.

From there, GEO generates large sets of prompts that reflect real buyer behavior. These include category searches, comparison questions, local intent queries, and trust-related checks. The language is natural and varied, reflecting how real people actually search. If AI is shaping discovery, you need to know how it responds across the full range of questions people actually use.

GEO then sends these prompts to supported AI models in parallel. Each answer is captured and analyzed. The platform identifies whether your business appears, how it is described, which competitors show up, and how strong your presence is across different types of intent. The value is not any single answer. It is the pattern that emerges across hundreds of them.

The final output is structured. It shows where you are visible, where you disappear, and where competitors dominate. It highlights areas where AI understands your positioning correctly and where the narrative begins to drift. It gives your team a measurable view of how AI interprets your brand at scale.

This turns AI from a black box into a channel you can monitor. You no longer have to guess how you appear in AI driven recommendations. You see it clearly, and you know exactly where improvements are needed.

What GEO Reveals: Insights You Can Act On

Where You Appear, and Where You Do Not

Once GEO completes a test cycle, the first pattern that stands out is simple presence. You see exactly where your business shows up in AI generated answers and where it disappears entirely. If you appear consistently across broad and specific prompts, you have something to build on. If you barely appear at all, the issue is not messaging or marketing, it is the fact that AI is not pulling your business into the conversation in the first place. This is the kind of blind spot most businesses never realize exists until they see the data laid out in front of them.

How AI Frames Your Services

Visibility alone is not enough. GEO shows how AI describes your business once it mentions you. Many companies discover that AI leans on outdated summaries, generic language, or information sourced from old third party listings. That disconnect explains why prospects may see a version of your business that does not match reality. GEO makes this misalignment obvious by comparing buyer intent questions with the actual wording AI uses when it talks about you.

Where Competitors Take Your Space

Competitor presence becomes clear the moment you filter by intent or region. If AI consistently recommends other providers ahead of you or excludes you entirely, the data exposes the pattern. Sometimes a competitor dominates only one category of prompts. Sometimes they appear across the entire spectrum. GEO allows you to see these patterns without guessing, which is often the first time a business gets a realistic picture of the landscape they are competing in.

The Prompts That Matter Most

Not every question a buyer asks carries the same weight. GEO highlights the prompts that shape the earliest stages of decision-making. These are the questions where recommendations influence perception before anyone reaches a website. You can see the prompts you win outright, the ones you lose, and the ones where you appear but with weaker framing. This is where priorities begin to form, because you can finally see which conversations deserve immediate attention.

A Roadmap Without Guesswork

When these insights come together, the story becomes actionable instead of abstract. You know where you stand, where the narrative breaks, and where stronger positioning will create the biggest improvement. Instead of chasing isolated AI outputs, you work from structured evidence, and the next steps become obvious. GEO does not just reveal how AI sees your business; it gives you the clarity to shape that perception going forward.

Turning AI Visibility Into Something Leaders Can Actually Use

Good data only matters if people inside the business can understand it quickly. GEO organizes every result so teams do not have to dig through transcripts or interpret screenshots from ChatGPT. The platform groups answers by intent, region, model, and competitor, which makes the patterns obvious even for someone who has never looked at AI visibility before.

Executives care about direction, not individual prompts. GEO shows them whether the brand is showing up more often, whether accuracy is improving, and where competitors are gaining ground. They can see which questions AI consistently answers in your favor and which questions leave you out entirely. This turns AI visibility into a metric leadership can review the same way they track search rankings or revenue channels Other teams benefit from the same structure.

- Product sees which features AI talks about most, which helps them understand what the market actually hears.

- Content sees where explanations are weak, which helps them create pages that support the narrative AI is already trying to form.

- Sales sees how AI positions the brand against competitors, which helps them prepare for the objections prospects already believe before the first call.

All of this is delivered in exportable, presentation-ready formats. Agencies can drop GEO outputs directly into client decks. Internal teams can send weekly or monthly summaries without rewriting anything. Instead of trying to “prove” a visibility issue, the data shows the pattern plainly.

Reporting is what makes AI visibility actionable. It creates a shared understanding across the organization, which is essential before you can fix anything. The next step is keeping that understanding accurate over time, because AI does not stay still.

From One-Time Audit to Ongoing Monitoring

A single visibility audit shows where your brand stands today, but it cannot tell you where it will stand next month. AI platforms update quietly, competitors change their positioning, and new content enters the web every day. These shifts influence how AI responds, sometimes dramatically, and most businesses never notice it happening.

Recurring monitoring solves that problem. GEO can re-test your brand on a schedule so you see how visibility evolves over time. The results form a timeline rather than a snapshot. If your brand begins appearing more often after a positioning update, you can see the improvement immediately. If a competitor suddenly starts dominating prompts they used to lose, that shows up just as quickly.

This matters because AI does not send warnings when something changes. It does not tell you when it begins using outdated descriptions, or when it discovers a competitor’s new content, or when it stops mentioning your product entirely. Without continuous tracking, these shifts become invisible until they affect revenue.

Alerts make the process even more practical. Instead of reviewing hundreds of prompts manually, teams receive notifications when visibility drops, when competitor mentions spike, or when AI begins repeating negative signals. Issues that once took months to uncover become visible in days.

Recurring monitoring turns AI visibility into a living metric. It gives teams a reliable way to track progress, maintain momentum, and catch problems before they spread across every major AI platform. With this foundation in place, the next step is understanding how AI evaluates trust, not just visibility.

AI Reputation and Trust Signals

Visibility gets your business into the conversation, but reputation determines whether AI treats you as a reliable choice. When a customer asks, “Is this service trustworthy”, “Is this company legit”, or “Who should I avoid”, AI pulls from cues that most businesses never monitor. These cues shape the tone of the answer, the confidence of the recommendation, and sometimes the final decision itself.

This is where many brands discover problems they did not know they had. AI may repeat outdated reviews, reference old complaints, or surface third party summaries that no longer reflect reality. In some cases, the system will frame competitors as safer, clearer, or more established, even when that is not true. These small distortions accumulate, and once they enter the model’s pattern, they can spread across dozens of prompts.

Reputation testing reveals these hidden signals. GEO checks how AI responds to trust oriented questions and how it evaluates your credibility. It surfaces the language AI uses, the sources it leans on, and the sentiment it attaches to your brand. It also shows whether your competitors are consistently framed in more positive terms, which often explains why visibility does not translate into recommendations.

This matters because trust prompts typically appear late in the buying journey. When someone asks AI for reassurance, they are close to making a decision. If the model offers a hesitant answer, or introduces doubt, or points them toward another provider, the sale can be lost before you ever know the inquiry existed.

Understanding these trust signals gives you a way to correct them. You can identify what information AI is pulling from, where your messaging needs reinforcement, and which gaps competitors are quietly filling. In a landscape where AI is learning continuously, improving reputation is not just damage control, it is a competitive advantage.

With trust and credibility defined, the next step is turning this data into something leaders can interpret and act on. That leads directly into advanced analytics.

Turning Signals Into Strategy: Advanced Analytics

Once you can see how often you appear and how AI talks about your business, the next step is understanding what that performance actually means. Raw visibility is useful, but leaders need clarity, context, and direction. GEO turns hundreds of AI answers into metrics that show where you stand and how far you have to go.

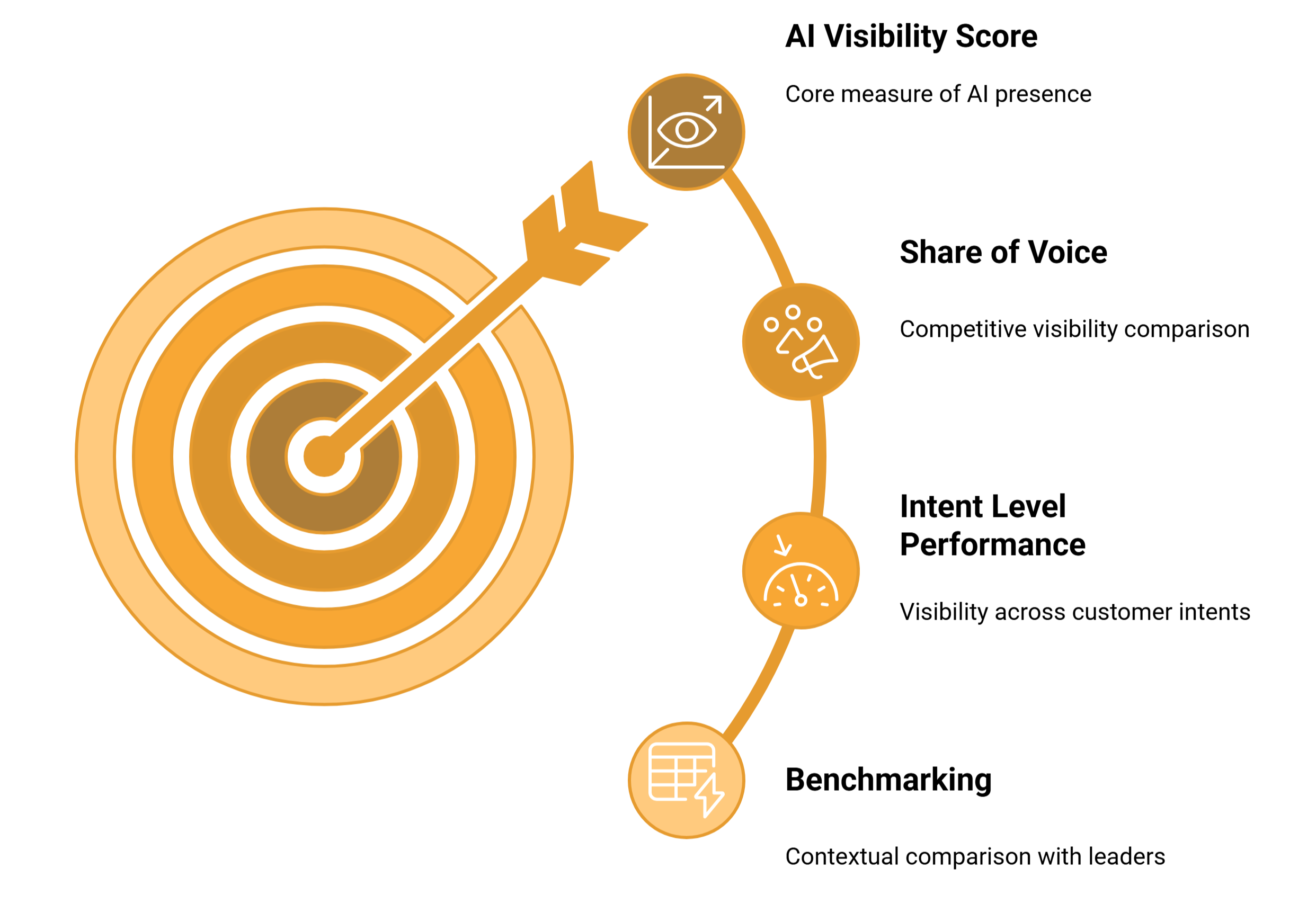

The first metric is the AI Visibility Score. It condenses your entire prompt set into a single reference point that shows how consistently your business appears across relevant questions. It gives you a baseline you can track over time, so improvement becomes visible instead of assumed.

Share of voice adds the competitive lens. It measures how often you show up compared to the businesses AI keeps suggesting beside you. You may be improving month to month, yet still losing ground because a competitor is accelerating faster. Share of voice exposes these shifts clearly, so you understand whether you are leading the conversation or being pushed out of it.

Intent level performance makes the story sharper. AI behaves differently depending on what the customer wants. Research prompts, comparison prompts, transactional prompts, and trust prompts each reveal a different part of the journey, and businesses rarely perform evenly across them. GEO breaks these patterns apart so you can see where the narrative is strong and where it falls apart. For example, you may appear consistently in broad “best local service” prompts but disappear the moment someone asks for pricing or reliability.

Benchmarking turns these insights into context. You can compare your performance with category leaders or the wider market to see whether your visibility pattern is typical or falling behind. This helps teams set realistic targets, prioritize investments, and identify blind spots that were previously invisible.

These analytics turn AI visibility from an abstract idea into a quantifiable advantage. They allow leadership to measure progress, forecast risks, and understand exactly where to strengthen positioning. With this strategic clarity in place, the next question becomes: who uses these insights inside the business, and how do they act on them?

How Teams Actually Use AI Visibility Data

AI visibility only becomes powerful when it influences real decisions inside the business. Once teams see how AI describes the brand, which competitors dominate key prompts, and where the narrative breaks, the insights stop being abstract and start guiding day to day work.

Marketing teams use visibility data to understand which parts of their message actually make it into AI answers. If core benefits never appear or AI keeps emphasizing the wrong points, the team knows exactly where the website, positioning, or ads need reinforcement. Instead of rewriting content blindly, they fix what AI is already misinterpreting.

Content teams stop guessing what to write next. GEO shows which questions matter most in the category and which prompts are consistently misunderstood or underserve the business. Writers get a clear list of topics that directly influence how AI describes and recommends the brand, not just what might perform well in search.

Product and category teams finally see how the market interprets what they offer. If AI places the business in the wrong category or compares it to the wrong competitors, that is a positioning issue, not a product issue. These insights help refine how features, services, and differentiators should be communicated across every channel.

Competitive intelligence teams get clarity they cannot get from search rankings or social listening. They see exactly which competitors win specific prompts, where they are gaining ground, and which areas represent opportunities to reclaim visibility. This shifts competitive strategy from guesswork to evidence.

Leadership teams use AI visibility as a top funnel health metric. When they can see where the business appears, where it falls out of the conversation, and how it is framed during key buying moments, strategic decisions become clearer. Budget allocation, messaging priorities, and market positioning all benefit from data that exposes early stage perception.

Every team gains something because AI visibility shows what customers hear before they visit a website or speak to sales. It reveals the first impression that now happens inside AI systems, not search engines, and it gives organizations a direct way to influence that moment.

The Future of AI Visibility: Why Early Adoption Wins

AI is becoming the front door to every market, which means visibility inside these systems will only grow more important. What we see today, with ChatGPT or Gemini shaping early research, is only the starting point. Models are being integrated into search, browsers, operating systems, customer service platforms, shopping tools, and every major workflow software. The influence is expanding quietly and rapidly.

As AI becomes the layer people consult before making decisions, businesses will no longer compete only for rankings or ad slots. They will compete for inclusion in the answers themselves. That shift turns AI visibility from a novelty into a core part of brand strategy.

The next phase of this category will focus on understanding the “why” behind AI recommendations. Businesses will want to know which signals carry the most weight, which narratives models rely on, and how small changes in content or reputation shift outcomes at scale. This moves AI visibility from surface level observation to deeper strategic insight.

Coverage will also broaden. We are already seeing specialized AI engines for travel, health, finance, education, and shopping. Each one interprets brands differently. Businesses will need visibility across a wider ecosystem, not just inside general purpose assistants. Early adopters will have historical benchmarks and stronger internal processes that late entrants will struggle to match.

Trust signals will matter more as well. AI systems are beginning to speak plainly about reliability, reputation, and legitimacy. If a business does not monitor how these signals evolve, it risks long term reputational drift as models continue learning from outdated or negative information. Fixing that early is far easier than correcting it later.

The companies and agencies that establish AI visibility now will control the narrative as this category matures. They will build the data foundation others rely on. They will learn what moves the needle and which signals influence inclusion. When AI becomes the primary interface for discovery, this early advantage compounds.

With the future direction clear, the next step is practical. Before you run an audit or change your strategy, it helps to know what working with a platform like this actually looks like in real life. These are the questions most teams ask first.

Freaquenly Asked Questions

1- How long does a full visibility audit take?

A complete run is fast. Brand research usually takes under a minute, prompt generation takes a few minutes depending on how large the set is, and the analysis itself finishes in seconds for around one hundred prompts.

2- Can I re-run the same prompts to see changes over time?

Yes. You can re-test any prompt set as often as you want. This is how businesses track improvements after updating content or positioning.

3- What happens if an analysis stops or fails?

Your progress is automatically saved. You can resume the run without losing data.

4- Can I customize the types of prompts generated?

Yes. You can add focus topics, adjust intent, and tailor the test set to match the questions your customers actually ask.

5- How accurate is the brand research?

The platform uses AI-powered web search to gather current information about your business. It builds a real snapshot based on what the internet says today, not outdated assumptions.

Start Your First AI Visibility Audit

The simplest way to understand your position inside AI generated conversations is to see the data for yourself. An AI visibility audit shows how often your business appears, how accurately you are described, and where competitors dominate prompts your customers are already asking. It replaces guesswork with a clear picture of how these systems interpret your brand today.

From there, the next steps become obvious. Some businesses discover small gaps they can fix quickly. Others find they are missing from entire categories where they expected to be visible. In both cases, the insight gives you control. You know what AI is saying, where the narrative breaks, and where strengthening your presence will have the most impact.

You can start with a single audit to get your baseline. Ongoing monitoring and reputation checks then help you stay visible as models update and competitors adapt. It becomes part of how you manage your brand, not an occasional curiosity.

If you want support running your first audit or building a process you can rely on every month, contact us and we can help you set it up. The important part is taking the first step. Once you see how AI talks about your business, everything else becomes easier to improve.