Beyond Net 30: Why Shopify’s Default Payment Logic Falls Short for B2B

Suppose you’re running a real B2B business, serving contractors ordering $200K in materials. In that case, procurement leads managing approval flows, buyers with 60-day payment cycles, and credit ceilings, Shopify’s native payment system is not built for you. It’s built for retail. And while Shopify Plus offers surface-level B2B features like draft orders and company profiles, they’re band-aids, not infrastructure.

In industrial ecommerce, payment isn’t just a checkout option. It’s a negotiation. A signal of trust. A tool for controlling margins, buyer risk, and operational liquidity. And when your platform can’t reflect that complexity, you’re not just creating friction, you’re losing deals you should have closed.

Let’s say your customer needs to submit a PO and pay on net 45 terms. They’re not clicking “Buy Now.” They need an approval process, invoice matching, and credit checks baked into their purchasing workflow. But on Shopify, unless you’ve built a custom payment term layer, that customer hits a wall. They either abandon the cart, flood your inbox with manual requests, or default to competitors who made the experience easier.

That’s the problem. B2B buyers expect the same operational flexibility they’ve had offline for years, but online. And unless your payment logic adapts to meet that expectation, your conversion rate isn’t just low. It’s structurally capped.

In this article, we’re going to walk through what it takes to build a real B2B payment system on Shopify Plus. Not a workaround. A real, extensible logic system that supports:

- Net payment terms (15, 30, 45, 60)

- Credit limits per company

- Role-based approval flows

- Partial payments and deposits

- Automated invoice generation

- ERP-linked balance visibility

This isn’t just about basic customization. It’s about control. Because if you’re managing 5,000 SKUs, 500 accounts, and a high-stakes reorder cycle, the way money moves matters.

We’re going to show you how to make Shopify behave like a B2B-native platform, without replatforming, duct-taping apps, or giving up on automation. We’ll break down how to implement advanced B2B payment logic using Shopify Plus, third-party tools, custom workflows, and architecture that doesn’t break when scale kicks in.

Let’s start where most people get stuck: what Shopify actually gives you, and what it doesn’t.

What Shopify Plus Offers (and Where It Stops)

Shopify Plus has made real progress with its B2B functionality, especially with tools like draft orders, company profiles, and limited payment permissions. But let’s be honest, what’s available natively is built for lightweight B2B operations, not for the layered complexity of industrial buyers with real payment structures.

At its core, Shopify’s out-of-the-box tools allow for some segmentation. You can create customer groups, assign payment permissions, and even draft custom orders. But those features rely heavily on manual input or surface-level automation. There’s no real system of enforcement behind them. Everything that happens after the checkout, terms enforcement, balance visibility, invoice status, and credit ceilings, is either missing or handed off to spreadsheets and siloed accounting tools.

Let’s say your business operates on Net 30 or Net 60 payment terms. Shopify Plus has no way to track when that payment is due, no way to alert the customer, and no mechanism to block future orders until that balance clears. If a buyer exceeds their agreed credit limit, there’s no logic in place to stop them at checkout. If they want to split payments between a deposit and post-installation balance, Shopify has no native model for staged invoicing.

And even the custom payment options it does offer, like letting a customer select “Pay by Invoice” at checkout, are cosmetic at best. Behind the scenes, your ops team is still manually issuing those invoices, reconciling payments in QuickBooks or NetSuite, and updating customer balances by hand. This isn’t just inefficient. It creates opportunities for delay, human error, and friction between finance and sales.

So while Shopify Plus is strong where it counts, stability, scalability, and frontend flexibility, it’s not a full B2B payments system. It needs to be extended. The native platform gives you the shell. But the logic, enforcement, and visibility do industrial buyers expect? That has to be built with intention.

This is where we start mapping the real architecture for payment terms that work, not just for your store, but for the finance team behind it and the customers relying on it.

What Real B2B Payment Terms Require (That Shopify Doesn’t Provide)

If you’ve ever sold into industrial accounts, you know payment is more than a transaction. It’s a negotiation and a relationship. And more often than not, it’s governed by pre-approved credit terms, staggered invoicing, multi-departmental workflows, and strict procurement rules that Shopify simply doesn’t account for.

Real B2B payment systems don’t operate like standard ecommerce. They’re built around trust and balance, not just checkout buttons.

To support payment terms like Net 30, Net 60, partial payments, pay-by-invoice, milestone billing, or credit ceilings, you need infrastructure that does three things really well:

1. Credit Logic That Mirrors Reality

You need a backend system that assigns credit limits to each customer, even each division within a customer account, and enforces those limits in real time. If a buyer has a $10,000 line of credit and they’ve already placed $8,500 in unpaid orders, the system should block or warn them before another order goes through. Not after. Not in an email later. It has to happen at checkout.

This requires dynamic credit tracking tied to order history, outstanding balances, and payment status. Shopify doesn’t offer that. So if you’re serious about terms, you’ll need to integrate logic that lives outside the default Shopify model, one that keeps customer balances accurate, visible, and enforceable across the storefront and ERP.

2. Payment Flexibility With Control

In industrial workflows, “pay now” rarely happens. Buyers want to check out via PO, get an invoice, send it to AP, and have their internal team cut the check in 30–90 days. Sometimes they need a down payment option up front, with the balance due on delivery, installation, or inspection. Other times, it’s milestone billing across phases of a custom project.

These aren’t edge cases, they’re the norm.

To handle this, your system must be able to trigger invoices at different stages, capture partial payments, tie payments to specific POs, and, critically, allow internal teams to approve or reject terms requests. Shopify offers none of this out of the box. And if your workaround is sending manual QuickBooks invoices after checkout, you’re already behind.

3. Visibility and Customer Engagement for Buyers and Internal Teams

Terms aren’t helpful if the buyer can’t see them. They need a dashboard where they can track open invoices, see what’s overdue, know how much credit they have left, and understand whether they’re cleared to place the next order. Just like your team needs visibility into who’s paid, who hasn’t, and how it ties into fulfillment.

This means building a real customer account portal—not just a generic “My Orders” page. It has to reflect payment history, order status, due dates, and any active terms. It also has to connect to your ERP or accounting system, so what buyers see matches your books.

The takeaway is simple: native Shopify doesn’t handle this. Not even close. If you’re serious about offering sophisticated B2B payment terms, you need to build a system that enforces logic, adds visibility, and fits into the financial workflows your customers are already using.

How to Architect a Terms-Enabled Payment System on Shopify Plus

You can’t duct-tape your way to functional B2B terms on Shopify. To make this work, you need a custom architecture that layers logic, syncs data, and speaks the language of both finance and operations.

This isn’t a Shopify problem, it’s a Shopify opportunity. Because once you understand its limitations, you can build past them. Here’s how.

1. Establish Credit Logic at the Data Layer

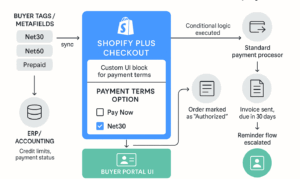

The core of any terms-enabled system is credit control. And Shopify doesn’t have a native concept of “credit” or “balance.” So you have to define it, using customer metafields, ERP integrations, or middleware.

Each customer gets a credit limit. That value lives in a custom field, sourced from your ERP or CRM. When an order is placed using terms, the credit balance updates automatically. No spreadsheets. No manual deduction. The logic must be enforced at the cart level; if credit is exhausted, the terms option disappears or triggers an override approval flow.

You’re building financial logic into the cart and checkout layer. That’s what prevents misalignment between promises made and actual accounts receivable exposure.

2. Enable Terms-Based Checkout Flows

Now that the credit logic exists, you need to build the checkout experience that reflects it. This means adding a payment option for “Pay by Terms” (usually via draft orders or custom scripts), and making sure it’s only available to approved customers in good standing.

Depending on your workflow, this can route through:

- Shopify draft orders with custom payment terms noted

- An integrated invoicing app is triggered on order submission

- Middleware that pushes orders into your ERP for billing

What matters most is that your customer can choose terms at checkout, and your system can enforce the rules in real time. Credit must be checked. Order totals must be validated. And your team should be alerted if a risky customer tries to place an order that exceeds the terms.

3. Sync Terms Data with Your ERP or Accounting Platform

The next layer is where many teams fail: syncing Shopify with the financial systems that actually govern terms. If your ERP shows a different balance than your Shopify metafield, you’re going to run into disputes, delays, and broken trust.

So the integration must be bi-directional. When a customer pays an invoice via ACH or wire, that update must flow back into Shopify, clearing the credit. When a new credit limit is assigned, it should automatically adjust the customer’s profile. This is what prevents human error and lets your operations team stop chasing spreadsheets.

If you’re using NetSuite, QuickBooks, or Sage, this sync can be handled via API, middleware like Celigo, or custom Shopify apps. But it must be real-time or near-real-time. A daily batch update doesn’t cut it for B2B.

4. Build a Transparent Buyer Portal

In B2B, your best buyers don’t just want a way to place orders. They want visibility. They want control. And more than anything, they want to know that your operations can keep pace with the trust and volume they’re extending to you.

A well-designed buyer portal isn’t a nice-to-have, it’s your must for building confidence.

When a procurement officer logs in, they should immediately see what finance sees. That means open balances are clearly displayed, recent invoices are downloadable without a support request, and upcoming payment dates are visible without any back-and-forth emails. It also means displaying current credit limits, not buried in a PDF or an email thread, but surfaced clearly so buyers can plan their next purchase with confidence.

Historical payment behavior matters too. A full ledger of payments received, terms extended, and account activity helps everyone stay on the same page, especially when large POs are involved or procurement teams change hands.

And this transparency has operational benefits for you, too. Fewer AR-related phone calls. Fewer “Can you send me that invoice again?” tickets. Fewer blockers for your sales team when they’re trying to close a reorder.

Technically, this kind of portal can be built directly inside Shopify using the Storefront API and Liquid templating, or extended with apps like Mechanic, Customer Fields, or even a React-based headless frontend. But the tools aren’t the point. What matters is that the interface supports the rhythm and reality of how your customers operate. No surprises. No guesswork. No friction when it matters most.

Because in industrial B2B, payment isn’t just about settling a balance. It’s about honoring the agreement behind that balance. And the more clearly you surface the state of that agreement, the more likely your customer is to trust it and keep coming back.

What Happens When You Don’t Build for Terms

Most Shopify stores weren’t designed with B2B terms in mind. And that’s exactly why so many B2B ecommerce operations implode behind the scenes.

You can have beautiful product pages, flawless marketing automation, and lightning-fast load times. But if your finance team is manually tracking who owes what, when it’s due, and how much credit they have left, your business is being held together with duct tape and luck.

Here’s what the fallout actually looks like:

Misaligned Orders and Approvals

Without integrated credit enforcement, customers can place orders even if their terms have expired, their credit is maxed, or their last invoice is 90 days past due. The order goes through. The ops team fulfills it. Finance sees it later and starts scrambling. The result? Internal friction, finger-pointing, and financial exposure.

Lost Time in Finance and Ops

Every manual invoice, every custom spreadsheet, every “Hey, did we get paid yet?” Slack message adds up. Your accounts receivable process becomes reactive instead of strategic. Instead of scaling cleanly, your back office becomes a bottleneck. And as order volume grows, that pain compounds.

Damaged Buyer Trust

In industrial B2B, your buyers aren’t just placing one-time orders. They’re planning around lead times, inventory cycles, and budget approvals. If they get hit with a surprise credit hold or can’t access their invoice history, it doesn’t just frustrate them, it erodes trust. You stop being a partner and become another source of friction in their already complex workflow.

Missed Growth Opportunities

Without proper terms infrastructure, your team avoids risk. You cap credit lines. You hesitate to approve large accounts. You slow-roll expansion into larger enterprise buyers because the backend can’t handle the complexity. Growth becomes gated not by demand, but by what your payment stack can’t support.

That’s the real cost of not building on the terms. It’s not just operational inefficiency; it’s lost trust, lost time, and lost upside. If you want to scale B2B ecommerce without turning your finance team into an AR call center, you need systems that think like your buyers do.

Architecting B2B Payment Flexibility in Shopify

This isn’t about patching over Shopify’s gaps. It’s about building a payment terms system that reflects how your customers actually buy. Use this toolkit to align your infrastructure with the reality of B2B cash flow, procurement cycles, and relationship-driven payment logic.

1. Payment Terms Logic Blueprint (Table)

| Term Type | Description | Shopify Native Support | Customization Required |

| Net 30 / Net 60 | Pay in full within 30 or 60 days | No | Yes (via app/custom dev) |

| Milestone Payments | Pay in stages (e.g. 30% upfront, 70% on ship) | No | Yes |

| Installment Plans | Equal payments over time | No | Yes |

| Volume-Based Terms | Payment terms triggered by order size | No | Yes |

| Customer-Specific Terms | Terms by account or buyer group | No | Yes |

| Credit Limit + Balance | Allow reorders up to a set limit | No | Yes |

2. Pre-Migration Checklist: Are You Ready for B2B Payment Logic?

☐ Do you track customer-specific credit limits today?

☐ Can your finance team reconcile orders and open balances in real time?

☐ Are payment terms managed in a centralized ERP or scattered across emails?

☐ Does your current ecommerce platform flag overdue balances before checkout?

☐ Are your sales reps manually quoting terms per order?

If you’re checking more than two of these, your current setup is a liability, not a strategy.

3. Developer Handoff Notes: What to Specify

When briefing your development team (or a Shopify agency), be explicit. Most missed requirements come from vague assumptions. Include:

- Payment condition triggers (customer tags, order volume, approval flags)

- Checkout flow expectations (pay now + terms split, invoice-only checkout, post-order settlement)

- Dashboard requirements (sales rep view, finance view, customer self-service portal)

- ERP sync logic (e.g. terms reflected in NetSuite or QuickBooks in real time)

4. Integration Stack Snapshot

You may need more than native Shopify apps. Here’s a lean architecture stack:

- Shopify Plus + Custom App Middleware – For terms logic execution

- ERP (NetSuite, Acumatica, Odoo) – For credit tracking, financials

- CRM (HubSpot, Salesforce) – For quoting and approval workflows

- Stripe or Braintree – For structured installment or milestone payments

Terms That Work as Hard as Your Sales Team

By now, it’s clear: native Shopify payment features weren’t built to handle the layered, negotiated, trust-driven payment dynamics of industrial B2B ecommerce. But that doesn’t mean you need to switch platforms. It means you need to out-architect the platform.

If you’re offering payment terms in a spreadsheet, tracking balances manually, or sending invoices from three disconnected systems, you’re not just inefficient, you’re scaling risk.

When you implement custom B2B payment logic inside Shopify, you help your sales team close with confidence, your finance team operate with clarity, and your buyers trust the system behind the transaction. Sales stops hesitating on bigger deals. Finance moves out of reactive cleanup mode. And buyers finally feel like you understand how their procurement process actually works.

And most importantly, your systems begin to match your ambition.

Payment terms are not a minor feature. They’re a signal of trust. And if your infrastructure can’t support that trust, your growth will always be capped, not by demand, but by operational drag.

Contact us and let’s move from workaround to weapon.