Credit Terms Are the Glue in Industrial B2B Relationships

For industrial suppliers, credit accounts aren’t a convenience. They’re currency. A handshake behind every PO, a line of trust that keeps million-dollar workflows moving without friction. When your customer places a $12,000 reorder for replacement hydraulic assemblies, they’re not pulling out a credit card. They’re relying on net terms—on the understanding that your business has approved their purchasing power and that your system will honor it.

But that fragile line of trust can break instantly during a platform migration.

Too often, companies migrating from a Volusion store to Shopify Plus assume their credit structure will carry over with the rest of the customer data. It won’t. Volusion may have let you configure basic net terms, manage AR balances manually, or flag customers for internal payment workflows. Shopify Plus, out of the box, offers none of that. No native credit terms. No stored limits. No balance tracking. Just a blank checkout page waiting for a card number.

That’s not just a technical gap. It’s a commercial risk.

If your biggest customer logs in post-migration and can’t check out with their terms intact, you’ve created a billing firestorm—and opened the door for a competitor to make the process easier.

This article is your blueprint to prevent that. We’ll walk through how to rebuild your Volusion-era credit logic inside Shopify Plus, preserve customer trust, and actually improve your credit management systems in the process.

Because trust isn’t just earned—it’s engineered across the whole process, from data mapping to the first post-migration order.

Volusion Credit Account Structures — What You’re Likely Working With Today

Before we talk about rebuilding, we need to get clear on what’s actually being replaced.

Volusion, for all its limitations, allowed industrial suppliers to implement customer credit logic that worked—or at least, didn’t break the relationship. Most B2B operators using Volusion over the past decade had some version of the following setup:

- Customers flagged manually or automatically for “Net 30,” “Net 60,” or custom credit terms.

- Per-account credit limits stored at the customer level—sometimes visible, sometimes internal-only.

- Offline invoicing logic, with orders placed through the site but paid by ACH, check, or via ERP-generated invoices.

- Manual processes for tracking balance usage, invoice aging, or credit lockouts.

- Occasional logic to prevent customers with overdue balances from placing new orders.

These systems were usually built through a mix of native Volusion features and custom back-office workflows. They weren’t elegant. But they were familiar. Sales teams knew how to check a customer’s balance. Finance knew how to reissue an invoice or approve a flagged order. And most importantly: customers could place orders without calling accounts receivable first.

All of this works—until you try to move it.

Because once you migrate to Shopify Plus, none of this structure comes with you automatically. Customer credit status, balance history, limits, flags—they don’t have a native home in Shopify’s architecture. If you don’t plan ahead, what you’ll end up with is a Shopify store that expects every customer to pay like a DTC buyer, and a sales ops team scrambling to approve orders manually.

So as we begin architecting your credit layer inside Shopify Plus, the first step is clear: identify every credit-related rule, permission, and expectation currently baked into your Volusion environment.

What isn’t documented needs to be. Because once we rebuild, every missing detail becomes a break in trust.

Shopify Plus Limitations: What’s Missing Out of the Box

Shopify Plus is powerful. But it wasn’t built for industrial B2B credit workflows—and that matters.

Out of the box, Shopify Plus treats every buyer like a direct-to-consumer customer. There’s no native concept of net terms, invoicing, or credit balances. Every customer is expected to check out immediately using a credit card, Shop Pay, or another real-time payment method. That’s fine for casual B2C purchases. But it breaks the model for large, ongoing procurement relationships.

Here’s what’s missing by default in Shopify Plus:

- No native credit limits per customer

- No built-in net terms or delayed invoicing

- No real-time balance visibility during checkout

- No enforcement logic (e.g., blocking customers over limit or past due)

- No integration with AR aging or offline payment tracking

In other words, none of the invisible scaffolding that supports your credit trust layer exists in Shopify’s native checkout logic.

Some merchants try to bridge this by using draft orders, manual invoices, or ERP-generated email follow-ups. But those are workarounds, not systems. They create friction. They put the burden back on your sales team. And worst of all, they confuse your customers—who are used to a seamless process that just works.

The good news? Shopify Plus is flexible. You can build a custom credit account engine on top of it. You just need to know how—and where—the architecture needs reinforcement.

The next sections will walk you through exactly how to recreate your Volusion-era credit workflows inside Shopify Plus, using customer tags, metafields, checkout logic, and third-party tools that respect the way B2B really works.

Because when the platform falls short, structure is what preserves trust.

Rebuilding Credit Workflows in Shopify Plus — Core Components of the Migration Process

To preserve customer credit relationships after a Volusion migration, you’ll need to rebuild your credit engine—intentionally. Shopify Plus doesn’t give you native tools, but it gives you the canvas to build what you need: custom checkout flows, customer-specific logic, and ERP integrations that reflect the complexity of industrial B2B purchasing.

Here are the foundational components to architect:

1. Store Credit Data Using Customer Metafields

Shopify metafields allow you to store custom data on customer records. This is where you’ll replicate key credit parameters:

- Credit limit (e.g., $25,000)

- Current balance (e.g., $6,400)

- Net terms (e.g., Net 30, Net 60)

- Status flags (e.g., On Hold, Overdue)

This data can be managed directly in the Shopify admin, via a private app, or pushed in from your ERP.

2. Control Checkout Access With Customer Tags

Customer tags can be used to grant or restrict access to the credit-payment checkout flow.

- Tag customers who are eligible for net terms (e.g., NET30_APPROVED)

- Use Shopify Functions or Shopify Scripts to conditionally show/hide payment methods based on those tags

- Add guardrails to block checkout for customers with overdue balances, using real-time logic tied to metafields

This builds your enforcement layer—ensuring customers don’t just see their terms, but are restricted to them.

3. Customize the Checkout Flow With Shopify Functions

Shopify Functions (available on Plus) allow you to customize the checkout experience server-side:

- Show “Pay With Net Terms” as a payment option for qualified customers

- Trigger a post-order flow that sends the invoice to AR or the ERP

- Insert warning banners or messages for customers nearing their credit limit

You’re not hacking the platform—you’re instructing it.

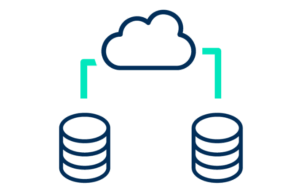

4. Sync With ERP or Accounting Systems

Your store isn’t the source of truth for balances—your ERP or accounting system is. Use middleware (like Patchworks, Celigo, or a custom-built API bridge) to:

- Sync credit balances daily (or more frequently)

- Lock accounts if an invoice ages past a threshold

- Automatically update customer metafields with balance, limit, or risk data

This closes the loop between customer behavior and financial governance.

5. Show Credit Status in the Customer Portal

Don’t hide credit information. Make it part of the buying experience. On the customer’s account page:

- Show available credit

- Display payment due dates

- Provide links to outstanding invoices

This increases trust, reduces inbound billing questions, and reinforces your professionalism.

When these pieces are working in sync, Shopify Plus becomes more than a storefront—it becomes an intelligent credit gateway, reflecting the nuances of how your customers already buy.

Keeping the Customer Experience Intact Post-Migration

You’re not just migrating platforms. You’re managing expectations.

When a buyer with net terms logs in and sees a foreign interface or loses visibility into their balance, it doesn’t just cause friction—it shakes trust. You might have rebuilt the backend perfectly, but if the customer-facing experience feels off, the entire migration risks falling flat. Consistency is the currency here. You don’t need to impress your buyers. You need to reassure them.

1. Mirror Familiar Interfaces

Industrial buyers don’t want surprises. If they’re used to seeing their outstanding balance the moment they log in, that needs to stay. If they’ve always been able to download a PDF invoice with two clicks, don’t make it three. Familiarity builds confidence, especially during transitions.

Your customers likely expect to:

- View outstanding balances from their account dashboard

- Pay invoices online without re-entering order details

- See terms (like Net 30 or Net 60) clearly marked during checkout

- Access downloadable statements or PDF invoices

You can mirror these expectations in Shopify by:

- Customizing the account page layout using Shopify’s Liquid templates

- Embedding a balance widget sourced from metafield data

- Linking to invoices stored in your ERP or hosted on a secure cloud service

- Using apps like Mechanic or Customer Fields to dynamically display contract terms

Keep in mind: they’re not asking for innovation. They’re asking for consistency. Deliver that first.

2. Pre-Train Accounts Before Launch

Don’t blindside your best customers. They shouldn’t find out about the new platform when they’re trying to place a rush order.

A few weeks before switching platforms, notify customers via email that:

- The store is being upgraded

- Their credit terms will be preserved (and how)

- They’ll now see clearer information on available credit, payment due dates, and past invoices

If you’ve got high-volume buyers or VIP accounts, go a step further—send them a short PDF walkthrough or demo video. Give them confidence that the switch won’t cost them time or money. Because the less they have to relearn, the faster they’ll trust the new system.

3. Keep the Sales Team In the Loop

Your internal team is the front line of trust. If something breaks or confuses the customer, the first call won’t be to tech support, it’ll be to their rep. And that rep needs to be ready. Make sure your sales and support teams:

- Know how the new system works

- Have access to credit info (either via Shopify admin or CRM/ERP)

- Can quickly override blocks or escalate issues to finance

Remember: migration isn’t just a technical shift. It’s a trust transition. You’re moving customers from a system that’s familiar to one that’s more powerful—but only if it still feels like it was built for them.

Mapping Volusion Credit Data to Shopify Plus

The real bottleneck in any credit-preserving migration isn’t logic—it’s data. Most industrial B2B businesses have years of customer records in Volusion that include credit terms, limits, balances, and transaction history. To preserve your customer relationships post-migration, you need to bring this data across with precision and integrity.

1. What Needs to Be Extracted From Volusion

If you miss the data, you break the trust.

The bottleneck in any migration isn’t just code—it’s what gets lost in translation. Most industrial suppliers running Volusion have accumulated years of customer history: negotiated credit terms, aging balances, transaction patterns, and internal flags. These aren’t just spreadsheet rows—they’re relationship markers. If that data doesn’t make it to Shopify cleanly, your customers will feel it instantly. So, before you flip the switch, you need a plan to preserve the meaning behind the numbers.

1. What Needs to Be Extracted From Volusion

Start with what matters. You’re not migrating fluff—you’re migrating financial trust. Your Volusion system likely contains:

- Customer account IDs (as primary identifiers)

- Assigned credit limit per customer

- Net terms agreement (e.g., Net 30, Net 60)

- Current balance or aging balances

- Last payment date and amount

- Open invoices or pending payments

- Custom credit statuses (e.g., On Hold, Suspended, VIP)

Unfortunately, Volusion doesn’t always package this data neatly—especially if you’ve used custom fields or hybrid ERP integrations. Expect to get your hands dirty with a combination of CSV exports and direct database queries. And be careful: this is sensitive data. One missed match or incorrect balance field, and you’ll create billing chaos.

2. Clean the Data Before Import

Never drop raw data into Shopify and hope for the best. You’re not just doing ETL. You’re preserving a revenue system. Take the time to scrub what you’ve extracted:

- Normalize customer names and emails — match with existing Shopify customer records to avoid duplication.

- Sanitize balance fields — verify that amounts are numerically formatted, rounded, and accurately reflect the ERP or accounting system.

- Flag stale accounts — don’t import inactive or zero-balance customers unless you plan to re-engage them.

Think of this as staging a clean foundation, not just porting over history. If your customer opens the new portal and sees an incorrect balance or broken credit status, the call they make won’t be to tech support—it’ll be to a competitor who can offer them a better experience.

3. Choose the Right Data Destination in Shopify

Shopify doesn’t have a default place for credit fields, but here’s how to store them:

- Customer Metafields: Ideal for storing credit limit, balance, terms, and status. These fields are extensible and can be pulled into frontend displays.

- Customer Tags: Use for high-level flags like NET30_APPROVED, VIP_ACCOUNT, or CREDIT_HOLD.

- Private Apps or Custom Apps: If you have a large volume of dynamic credit data (like real-time invoice syncing), a private app can manage syncing and logic enforcement.

Example mapping:

| Volusion Field | Shopify Destination |

| Credit Limit | Customer Metafield |

| Current Balance | Customer Metafield |

| Net Terms (e.g., 30) | Customer Tag (NET30) |

| Credit Status | Tag + Metafield |

| Open Invoices | Linked ERP or Middleware |

4. Set Up Ongoing Sync or Manual Update Process

Even after migration, the credit data won’t sit still. Balances change, payments post, and orders flow in. You’ve got two options: automate or manually maintain.

- An automated sync—using middleware like Patchworks, Alloy, or a custom API—lets your ERP push updates into Shopify metafields in near-real time.

- A manual admin workflow, while lower-tech, can still work at smaller volumes. Train your finance team to update key fields after invoices are paid or terms shift.

Both are valid. What matters is consistency. Because once the system is live, “I didn’t see the updated balance” is no longer a valid excuse. And in B2B, a missed signal can lose you a million-dollar reorder.

Enhancing Credit Management With Shopify Ecosystem Apps

Once your baseline credit logic is mapped into Shopify, you’ve done more than preserve function, you’ve unlocked the opportunity to actually improve how credit is managed across your business. Shopify’s app ecosystem isn’t just a toolbox; it’s a modernization layer. You can automate approvals, enforce boundaries with precision, and give your team a radically clearer view of every account’s financial posture.

1. Credit Limits Aren’t Optional—So Make Sure They’re Respected

By default, Shopify Plus doesn’t stop a customer from placing an order—even if they’ve hit their credit ceiling. That means a Net 30 buyer with $0 available can still submit a $5,000 PO—and now your team is on the hook to enforce it manually.

To prevent this, bring logic right to the edge of checkout:

- Use Shopify Functions to run conditional checks against each customer’s credit balance, stored in a metafield or synced via your ERP.

- Trigger dynamic messaging that stops the order and sets expectations:

“This order exceeds your approved credit line. Please contact your account manager to proceed.”

It’s clean, non-confrontational, and operationally sound. Customers feel protected, not blocked—and your finance team doesn’t have to clean up the mess afterward.

2. Automate Net Terms So You Don’t Manually Chase AR

If you offer deferred payment (Net 30, 60, or custom terms), your process shouldn’t depend on email threads and accounting chases.

Tools like Apruve, Balance, or B2B Wave bring structure to the chaos:

- Customers can place orders under approved terms

- Invoices are auto-generated and tracked

- Payment due dates sync to aging balances

- Finance teams gain visibility without lifting a finger

These tools also integrate with your ERP and processors, ensuring that nothing falls through the cracks—and no one wastes time exporting spreadsheets just to know who owes what.

3. Give Finance a Live Window Into the Credit Reality

Finance shouldn’t have to guess whether a customer is still in good standing. And sales shouldn’t be in the dark about who’s over limit until a PO gets rejected.

Make the credit picture visible:

- Display real-time credit limits, balances, and terms directly inside the Shopify admin, using metafield extensions or custom dashboards.

- Trigger internal notifications when:

- An overdue balance surfaces

- A flagged customer places a repeat order

- An account approaches their credit ceiling

By syncing ERP updates to Shopify, you keep every team aligned, proactive, and responsive. Nobody’s surprised. Nobody’s delayed.

4. Use Shopify Tags as Automation Triggers, Not Just Labels

Customer tags aren’t just labels—they’re triggers.

Paired with Shopify Flow or other automation tools, they let you build intelligent workflows that adapt to the financial posture of each customer.

- CREDIT_HOLD → Pause fulfillment until finance clears the account

- NET60 → Automatically attach a 60-day payment invoice

- VIP_ACCOUNT → Ping the assigned sales rep for white-glove handling

Now your store doesn’t just display credit logic—it enforces it, automates it, and wraps it in a service experience that customers feel and trust.

Frontend Experience: Helping Credit Customers Feel at Home

Even if your backend credit workflows are perfectly mapped, your customer’s confidence hinges on what they see. For industrial suppliers migrating from platforms like Volusion, this is where the rubber meets the road. Your credit customers don’t care about how smart the logic is behind the scenes. They care about predictability, clarity, and continuity.

These buyers aren’t browsing like B2C consumers. They’re not reading reviews or comparing specs for fun. They’re coming in with a purpose—to reorder parts, submit purchase orders, or reconcile invoices. And if they’re on credit terms, their mindset is laser-focused: “Do I have enough available credit? Will this order go through? Where’s my invoice from last month?”

Shopify Plus gives you the infrastructure to answer those questions proactively. But only if you architect the frontend to surface what matters.

1. Add Credit Status to the Customer Dashboard

The moment a B2B buyer logs into your site is your best chance to build trust. This isn’t the time for a generic account page. Instead, greet them with clear credit visibility: their available credit, current balance, and any overdue amounts should be front and center. For example, “$4,250 of $10,000 available” gives them instant clarity.

This can be done by embedding custom Liquid templates and metafields that pull in real-time data from your ERP or middleware layer. PDF invoices or balance statements should be downloadable directly from the dashboard—no phone call required, no “we’ll get back to you” from accounts receivable.

2. Reinforce Terms in the Checkout Flow

Checkout is often the moment of truth. If the buyer isn’t sure how they’re being billed—or if they even have credit left—they hesitate. That hesitation kills conversion.

You can prevent it by embedding trust cues directly into the checkout process. Show that Net 30 or Net 60 is active. Reinforce that they won’t be charged immediately. Include a field for “PO number” with instructions, and display their available credit right next to the payment option.

These small confirmations go a long way in keeping large buyers from second-guessing the process.

3. Surface Credit Usage in Order Confirmation

Post-purchase communication is where most B2B brands drop the ball. Don’t just send a generic “thanks for your order.” Use the order confirmation to reinforce what they need to know, how much credit they’ve used, what their current balance looks like, and when payment is due.

For example: “You’ve used $1,800 of your $5,000 credit limit. Payment due July 15. View invoice.” This message turns your confirmation into a financial checkpoint. It also reduces support tickets and gives your finance team breathing room.

4. Allow Credit Applications for New Customers

Credit shouldn’t feel like a legacy accommodation—it should be positioned as a premium buying option. If you want to grow usage, make it easy for new or mid-sized accounts to request terms directly from the storefront.

Place a CTA on key pages like: “Need Net 30 terms? Apply here.” That link can route to a Typeform, downloadable PDF, or embedded application tied to your CRM or finance workflow. Make it feel professional. This turns your credit offering into a lever for acquisition, not just a backend operational headache.

Store Migration Without Downtime: Pre-Migration Planning & Customer Communication

One of the biggest fears when migrating customer credit accounts is disruption—orders getting stuck, credit terms lost, or loyal accounts left confused. But with the right plan, you can move from Volusion to Shopify Plus with zero downtime and zero panic. It’s not just about data migration. It’s about expectation management.

Here’s how to do it right.

1. Lock Credit Data Before the Cutover

Before you shut off Volusion, freeze your credit records:

- Pull a snapshot of all open balances, limits, and terms

- Export this into a structured format (CSV, database, or middleware input)

- Flag any anomalies or stale accounts to clean up during migration

Why it matters: Without a locked version of this data, your post-migration reconciliations will be a mess. Don’t rely on last-minute exports or manual entries.

2. Map and Test Data Before Launch

Don’t wait until go-live to test. Set up a sandbox store in Shopify Plus where you:

- Import a batch of customer records with credit terms

- Simulate real orders to ensure limits and terms are enforced

- Validate ERP syncs: Does credit usage update after a new order?

Run this test with your finance and sales teams involved. Their buy-in is critical for confidence on day one.

3. Stage Your Email and On-Site Communication

Loyal customers with credit terms should never be surprised. Send them a heads-up email a week before migration:

“We’re upgrading your experience. Your account, credit terms, and order history will move seamlessly to our new Shopify-powered store. You’ll receive a link to reset your password. Nothing else changes.”

On the new site, add a banner or modal on login pages:

“We’ve moved! Your account and credit terms are already live. Need help? Contact your rep or .”

The more confident you are in your messaging, the smoother the transition will feel to the customer.

4. Monitor First-Week Activity Closely

After launch, designate internal eyes on:

- High-volume accounts: Are they logging in and ordering?

- Credit order flow: Are invoices being generated and routed correctly?

- Support tickets: Any confusion around payment terms?

If needed, set up real-time alerts for any order tagged CREDIT_TERMS so your ops team can double-check fulfillment and invoicing.

Migration isn’t just about systems. It’s about trust. And in B2B, trust is earned by keeping your word—even during backend transitions.

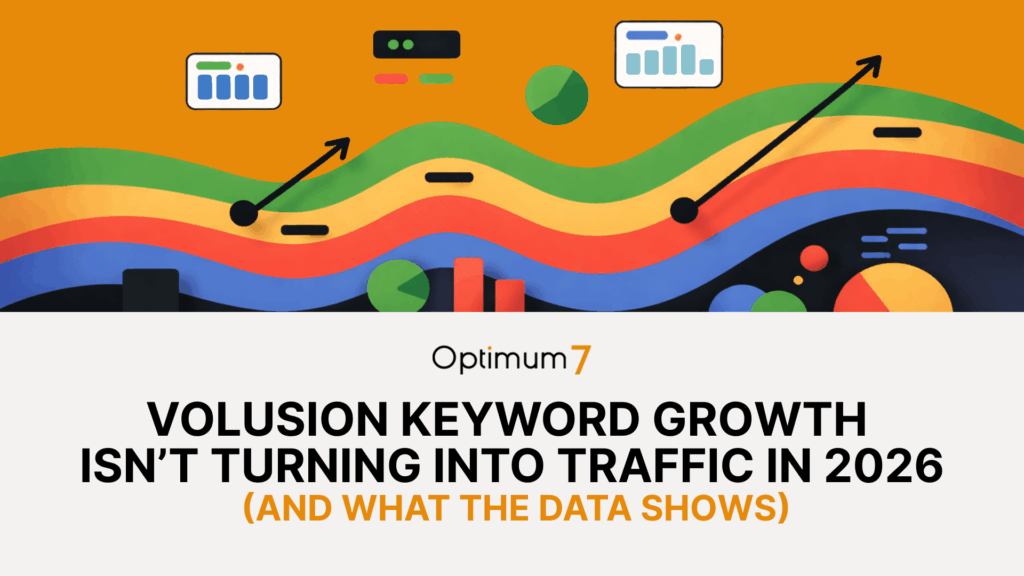

Post-Migration Optimization: Turning Credit Terms Into a Competitive Advantage

Getting your customer credit accounts live in Shopify Plus is a win. But the real value comes after launch—when you turn those terms into a growth lever instead of a maintenance headache. Most suppliers stop at preservation. The smart ones use this moment to upgrade the way they sell, retain, and expand.

Here’s how to make credit a strategic asset post-migration.

1. Use Credit Terms to Incentivize Larger Orders

You’ve already got the data. Use it.

- Offer Net 30 terms only on orders above a certain threshold (e.g., $1,500+)

- Create incentive tiers: Net 15 for <$1,000, Net 30 for $1,500+, Net 60 for $5,000+

- Test longer terms for your top customers and monitor retention/lifetime value

This turns your finance policy into a sales strategy.

2. Surface Credit as a Differentiator in Your UX

Most competitors treat credit as a behind-the-scenes feature. You don’t have to.

- Add “Credit Available” tags to product pages or catalog listings

- Let customers filter by what’s eligible for Net terms

- Promote your credit options on landing pages and paid campaigns

You’re not just selling parts—you’re selling purchasing flexibility.

3. Integrate Credit Data Into Your ABM Strategy

For companies running Account-Based Marketing or targeted outbound sales, credit terms are gold:

- Use order history + credit usage to trigger upsell campaigns

- Route accounts with underused limits to sales reps for reactivation

- Score leads based on credit eligibility or pre-approved terms

This turns your accounts receivable data into a demand generation engine.

4. Monitor Credit Health Like a Product Funnel

Don’t let credit sit in the dark.

- Track open balances, usage rate, and repayment speed

- Segment customers by credit activity (e.g., frequent users vs inactive)

- Set thresholds for proactive outreach (e.g., “credit limit >80%” triggers rep follow-up)

Tools like Glew, Daasity, or even Google Looker Studio can help visualize this post-migration.

ToolkCredit Account Migration Planning in Shopify Plus

A lightweight, high-impact resource to help your B2B credit migration succeed without disruption.

Pre-Migration Checklist

| Task | Status |

| ☐ Audit all active credit accounts in Volusion | |

| ☐ Export credit limits, open balances, terms, and customer groups | |

| ☐ Clean outdated or inactive accounts before import | |

| ☐ Map Volusion fields to Shopify Plus metafields or customer tags | |

| ☐ Identify ERP sync logic for credit balance and invoice updates | |

| ☐ Create a sandbox Shopify environment for test import | |

| ☐ Simulate credit orders and fulfillment flow with internal users |

Credit Logic Mapping Table

| Volusion Field | Shopify Equivalent | Notes |

| Credit Limit | Customer Metafield | Use a custom field like credit_limit_usd |

| Net Terms | Customer Tag / Metafield | e.g., net_30, net_45 |

| Open Balance | ERP Synced Field | Sync with NetSuite, Acumatica, etc. |

| Rep Assignment | Customer Tag | Use for frontend personalization |

| Credit Eligibility | Tag + Conditional Logic | Show “Pay via Credit” at checkout |

Post-Migration QA Actions

| Check | Owner | Frequency |

| Credit orders flowing to ERP? | Dev / IT | Daily for 2 weeks |

| Limits updated after invoices? | Finance Ops | Weekly |

| Any credit-related support tickets? | Support | Hourly (first 72 hrs) |

| Are top accounts actively ordering? | Sales | Weekly |

Credit Isn’t Just a Feature — It’s a Relationship

When B2B customers buy on credit, they’re not just placing orders—they’re extending trust. And that trust hinges on your ability to honor terms, balances, and buying history without disruption. A sloppy migration breaks that trust. But a thoughtful, structured transition—from Volusion to Shopify Plus—can actually deepen it.

This isn’t just about preserving functionality. It’s about modernizing how credit operates in your sales ecosystem. Done right, credit becomes more than a backend ledger. It becomes a sales lever, a retention signal, and a loyalty asset.

At Optimum7, we’ve helped industrial suppliers move complex credit logic into scalable Shopify Plus architectures—with ERP syncs, contract logic, and UX clarity that empowers the customer instead of confusing them.

If you’re planning a platform switch and need a migration service that preserves credit without compromise, contact us.

We’ll audit your existing setup, guide you through the entire migration, and build a credit system in Shopify Plus that doesn’t just match Volusion—it outperforms it.