Executive Summary

Let’s get one thing out of the way: most cold outreach fails because it’s built on hope. Not data. Not insight. Not buyer psychology. Just… hope.

You write a catchy subject line. You follow the “best practices.” You even use a fancy tool to personalize the first line. And then nothing happens. No reply. No meeting. Just silence.

Here’s why: buyers don’t care what you think they care about. They care about what they’re already searching for. And these days, they’re not typing those questions into Google. They’re asking ChatGPT. Perplexity. Claude.

That’s the shift most sales teams haven’t caught.

Buyers are offloading their curiosity onto LLMs—and those queries? They’re raw, honest, emotional. “How do I justify a new vendor to my CFO?” “Is it even worth switching PR firms?” “What’s the risk if I ignore ADA compliance?”

We built a system around those signals. We call it AI Visibility Intelligence—and it lets us engineer cold outreach campaigns that don’t feel cold at all. Because they speak directly to the headspace your buyers are already in.

In this article, we’re giving it all away.

You’ll see how we mine AI engines for buyer confusion, how we structure emails that convert from email #1, how we route replies without losing deals, and how we closed $80K+ in MRR in 45 days with zero ad spend.

This is not another cold email playbook. This is the next generation of outbound—built on real-time buyer intelligence.

The Death of Generic Outbound

Why Cold Email Has a Bad Reputation in B2B

Cold email didn’t die—it just got lazy.

For the last 10 years, sales teams have treated outreach like a slot machine. Load a list, spin the personalization lever, hit send. Maybe something hits. Most of it doesn’t.

B2B buyers are immune now. They’ve seen it all:

- The fake compliment opener

- The “Quick question” subject line

- The calendar link dropped 3 sentences too early

They don’t trust cold outreach because it feels like it’s written for everyone and no one at the same time. And they’re right. Most cold emails could be sent to 500 people without a single word changed. That’s not outreach. That’s spam with better formatting.

“Best Practices” Are Now Spam Triggers

The very tactics that once made cold email effective are now what get you flagged.

Here’s what Google and Microsoft’s AI spam filters are penalizing in 2025:

- Overused subject lines: “Just following up,” “Quick intro,” “Can I help?”

- Message structure that mimics templates (3-paragraph pitch with a CTA)

- Overpersonalization with no insight (e.g., “I saw you went to ”)

Your deliverability tanks before you even get a chance to be ignored.

Even when your message does land in the inbox, it reads like a hundred other pitches. There’s no signal. No hook. No reason to reply.

And let’s be honest—your buyer’s inbox is smarter than your sequence.

The Search vs. Sales Disconnect

Most cold outreach still assumes that sales reps know what buyers care about.

They don’t. And that’s not an insult—it’s just outdated methodology. Reps are told to sell features. But buyers aren’t searching for features.

They’re asking questions like:

- “What CRM integrates best with our ERP?”

- “How do I stop our emails from hitting spam folders?”

- “Is B2B PR still worth it in 2025?”

Your buyer isn’t typing “multi-channel marketing automation” into ChatGPT. They’re typing “how do I get more demos booked without hiring 3 more SDRs?”

That’s the disconnect. Reps talk in product. Buyers think in problems.

The result? Cold emails that don’t even enter the right conversation.

B2B Complexity Makes Irrelevance Easy

Most sales teams underestimate just how fragmented B2B buying is.

Take a typical SaaS deal. You’ve got a CMO, a RevOps lead, a data engineer, a legal reviewer, and maybe a security auditor—all involved in the decision.

Now imagine sending one message trying to speak to all of them.

You get: “We help modern teams collaborate better through seamless integrations and world-class analytics dashboards.”

Nobody replies to that.

Because the CFO is wondering about switching costs.

The CMO wants to see social proof.

The engineer needs to know if it works with their stack.

And none of them see their question reflected in that email.

This is where cold email dies—not because it’s unsolicited, but because it’s irrelevant.

Sidebar Punchline:

“If your cold emails could’ve been written without any market intel, your buyers will delete them without a second thought.”

Cold outreach isn’t failing because buyers are impossible to reach.

It’s failing because your message is disconnected from the questions they’re already asking.

And in 2025, there’s one place where all those questions live:

AI engines.

Ready to see how we mine ChatGPT, Perplexity, and Claude to write cold emails that actually get replies?

Let’s go deeper.

AI Engines Are the New Buyer Intent Signals

There’s a quiet revolution happening in the way B2B buyers do research—and most sales teams haven’t caught it yet.

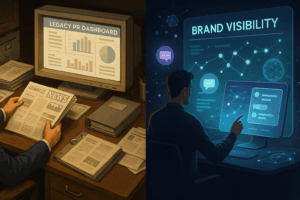

Five years ago, discovery started with Google. You ranked on a few industry keywords, bought some branded search traffic, and assumed that your cold outreach just needed a clever subject line to work.

That playbook’s dead.

Today’s B2B buyer doesn’t open a browser when they’re confused or curious. They open ChatGPT. Or Claude. Or Perplexity. That’s where the real search begins now—not in SERPs, but in prompts. Not in blog posts, but in conversations.

So when a RevOps lead at a SaaS company wants to know which CRM works best with NetSuite, they’re not reading ten comparison guides. They’re asking GPT:

“Which CRMs integrate best with NetSuite for B2B SaaS companies with multi-tiered pricing models?”

And that prompt? That’s your window.

If your brand doesn’t show up in that answer, it’s not just invisible. It’s excluded.

This is the new front line. Visibility inside LLMs has become the modern buyer’s litmus test for relevance. And if you don’t know how your brand performs inside those AI engines, you’re flying blind.

ChatGPT Isn’t Your Blog Reader—It’s Your Buyer’s Shortlist Tool

We treat ChatGPT like the new Gartner Magic Quadrant. It’s the place your prospects go when they want to understand a market, compare solutions, and make their own internal case for change.

No one wants to jump on five vendor calls anymore. They want a synthesized answer that helps them look smart in the next team meeting.

When they ask GPT, “What’s the best email deliverability tool for cold outreach?” and your name isn’t there, you don’t even make the short list.

But here’s where it gets interesting. Sometimes GPT’s answers are vague, outdated, or completely generic. That’s not a problem—it’s an opening. Because when the LLM gives bad info, your cold email can step in as the correction.

One of our most effective hooks?

“We asked ChatGPT how to fix deliverability issues in cold email. The answer? Wrong—and here’s why.”

It doesn’t feel like a pitch. It feels like insight. Because it is.

Perplexity Exposes What Buyers Don’t Understand—And Who’s Filling The Gap

If ChatGPT shows us the answers, Perplexity shows us the struggles. It reveals the questions your buyers are asking that no one seems to answer well.

We’ve seen B2B founders type in prompts like:

“Is it worth switching CRMs just for better attribution?”

“What happens if we skip SOC2 for now?”

“How do I know if our PR is actually helping pipeline?”

These aren’t feature requests. They’re signs of pain, confusion, indecision.

Perplexity also shows who’s dominating the answer space. If your competitor’s blog keeps getting cited—or worse, if Reddit does—you’re watching the conversation slip out of your control.

When that happens, we know exactly what to do.

We don’t argue. We reframe. We write cold email hooks that say:

“We saw what Perplexity says about switching CRMs. Here’s what they’re missing—and what your CFO actually wants to know.”

It doesn’t matter if they’ve never heard of you. If you fix the confusion that Perplexity exposed, you’ve earned the conversation.

Claude Doesn’t Just Answer Questions

Claude is our compass for tone. It shows us how buyers talk to themselves.

When someone asks Claude about ADA compliance, it doesn’t just list regulations. It frames it emotionally—risk, fear, “what if we get sued.” That’s your cold email tone, handed to you on a silver platter.

If Claude’s output says, “ADA non-compliance can result in lawsuits and brand damage,” then your email doesn’t start with “We help make websites accessible.”

It starts with:

“You’re one audit away from a headline. ADA lawsuits are up 300% this year. Let’s talk about what your homepage says to a screen reader.”

Claude tells us what buyers care about—beneath the question. And when we echo that tone in cold email, the buyer sees us as aligned, not intrusive.

The New Research Workflow Starts In An LLM

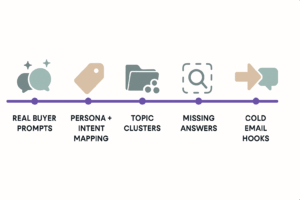

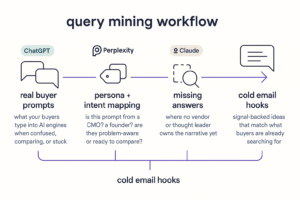

We call this process Query Mining. We don’t guess what to say in our emails. We go straight to the source: the prompts your buyer is already typing.

We look at real prompts, like:

“Who are the top PR firms for AI startups that don’t do fluff?”

“Is Perplexity a threat to Google for B2B content strategy?”

“How do I get visibility in ChatGPT without paying for backlinks?”

We break them down by role—CMO, CTO, COO, founder.

We tag them based on intent—confused, curious, ready to compare.

And then we look for the gaps—where buyers are clearly trying to make a decision, but the answers suck.

That’s where our cold emails come in. Not to pitch.

To clarify. To elevate. To reframe the entire conversation.

Real Story: Using AI Visibility To Land Enterprise Security Leads

We worked with a cybersecurity SaaS brand that was struggling to get enterprise leads. Sales said the pitch was strong. The emails were getting opened—but replies were ice cold.

So we looked at what their buyers were typing into Perplexity and GPT.

Things like:

“Is SOC2 enough for healthcare clients?”

“Best practices for HIPAA compliance when using Okta + Google Cloud”

The answers were vague. Mostly blog spam from 2021.

So we built a cold email that said:

“We asked GPT if your cloud stack is HIPAA-ready. The answer: maybe. Here’s what every security lead misses—and how we fixed it in under 30 days for a healthcare system just like yours.”

They booked 12 SQLs in two weeks.

Not because the product changed.

Because the signal changed.

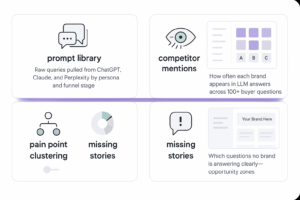

Building the AI Visibility Report

Once we’ve tapped into what buyers are asking AI engines—once we’ve collected that messy, confused, emotionally-charged search behavior—we don’t stop there.

We turn it into something actionable. Something strategic.

We call it the AI Visibility Report. It’s not a dashboard. It’s not a pile of data. It’s a narrative intelligence blueprint that shows you three things:

- What your buyers are confused about.

- Who’s showing up in the AI conversation.

- Where your brand is missing—and how to own the gaps.

This report is the heartbeat of every cold outreach campaign we run. It tells us what angles to hit, what objections to pre-empt, and which competitors we need to knock off the map.

Let me walk you through exactly how we build it.

We always start with the buyer, not the brand

First rule: we don’t begin by asking “What are we trying to sell?”

We begin with, “Who are we trying to understand?”

That means mapping out real ICPs—not vague buyer personas from a slide deck, but the actual roles that hold the budget, raise concerns, and block deals.

For one client in the rugged tech space, that meant field operations managers, procurement officers, and IT directors. Three completely different mindsets. Three different sets of fears.

Operations worried about durability.

Procurement cared about vendor lock-in.

IT wanted integration with legacy systems.

One cold email wouldn’t cut it. So we had to find three different entry points—and that started with signal.

We go into the LLMs and pull what your buyers are actually asking

This isn’t SEO research. We’re not looking for keyword volume.

We’re extracting actual prompts your ICPs are typing into GPT, Claude, and Perplexity.

Stuff like:

- “Best waterproof barcode scanners with offline mode”

- “Can I get a rugged tablet that runs on Windows 11 and syncs with SAP?”

- “What logistics tech survives field deployment without constant IT support?”

Nobody’s optimizing for those questions in traditional SEO. But they are the exact problems buyers want solved.

So we take those prompts and build a library. Hundreds. Sometimes thousands.

And we start connecting the dots.

Then we figure out who’s winning the conversation—and who isn’t

For every category, there are brands that show up by default.

Sometimes they deserve it. Most of the time, they don’t.

We run prompt after prompt and track the output:

Which companies get cited? Which blog posts get quoted? Are they vendor-owned? Neutral? Completely irrelevant?

For our rugged tech client, Amazon listings were dominating the space. Not a single vendor site showed up for key functionality queries. Not one.

And that told us something important: the story wasn’t being told by the people who built the product. It was being told by distribution channels and old PDFs.

Huge opportunity.

We cluster the themes—and then we spot the blind spots

Here’s where things get fun. We tag and cluster all the questions by theme.

For example:

- Compliance: “Is this product OSHA-approved?”

- Cost sensitivity: “Why are rugged tablets so expensive?”

- Speed of deployment: “Can this be used out of the box?”

- Integration needs: “Does this connect with our asset management system?”

These clusters help us understand what type of friction is dominating the conversation. Not just what buyers want—but what’s slowing them down.

Then we layer on what we call narrative voids—the questions no one is answering well.

If no brand is showing up to answer “How do I get rugged tech deployed without training field staff?”, then your cold email starts there.

What we’re left with is gold: a complete map of buyer confusion, competitor saturation, and emotional triggers

We package this into the AI Visibility Report. It includes:

- A breakdown of which brands show up in which query themes

- A scorecard of where you’re present, weak, or completely absent

- Buyer questions sorted by ICP and concern

- Emotional trigger zones—fear, urgency, status, FOMO

It’s not just data. It’s a narrative weapon.

For the rugged tech client, we found that nobody was addressing “field survivability” in a way that felt operational. It was all specs and IP ratings.

So we wrote:

“We asked GPT what tech survives six months in the field without babysitting. The answer? Not yours. Let’s fix that.”

They booked their first enterprise ops lead from that sequence. Not because the product was different. Because the angle was finally right.

Translating Signals Into Angles That Sell

Once we’ve built the AI Visibility Report and surfaced real buyer signals, it’s time to convert those insights into cold outreach that gets responses. Not just clicks. Not vanity open rates. Actual replies that turn into qualified sales conversations.

This is the part where we separate campaigns that feel personalized from those that are relevant. Because personalization without signal is still guesswork. But when you speak directly to the buyer’s headspace—their confusion, curiosity, and urgency—you don’t have to try hard to earn attention. You just have to show you’ve been listening.

It always starts with empathy, not persuasion

Most cold emails die in the first sentence because they jump into pitch mode.

You know the format: “Hi , I saw you went to and wanted to reach out because we help companies like yours…”

That worked when inboxes were quiet. They’re not anymore. Every B2B buyer has seen that structure a hundred times this month alone.

When we write cold emails, we don’t try to sound clever. We try to sound useful. And we lead with what the buyer is already thinking about—because we’ve seen what they typed into ChatGPT or Perplexity.

So instead of, “I wanted to introduce our solution,” we start with:

“We saw what Perplexity says about switching CRMs in under 30 days. The answers were…not helpful. Here’s what actually works.”

We don’t ask for trust. We show we’ve already done the research on their behalf.

We look at the gap, then build the bridge

Every great angle starts with tension. A gap between what the buyer wants to be true and what they’re currently seeing in their research.

Let’s say dozens of security leads are asking:

“What happens if we skip SOC2 for now?”

And Claude responds with vague risk language and links to outdated blogs.

That’s the bridge we build:

“We asked Claude what happens if you skip SOC2. It pulled articles from 2021 and some general legal advice. We built a faster path—SOC2 compliance without slowing your release cycle. Want a teardown?”

This doesn’t feel like spam. It feels like relief.

Because now you’re not interrupting their day—you’re helping them resolve something that’s been sitting in their mental browser tabs for weeks.

It’s also about knowing which emotion to lead with

Buyers don’t act because of features. They act because of emotional stakes.

Fear of making the wrong choice. Pressure from the board. FOMO from seeing competitors show up first.

So when we mine signals, we don’t just ask “what are they asking?”

We ask, “What’s underneath this question?”

If a founder types:

“How do I get visibility as an AI startup raising a seed round?”

What they’re really asking is:

“How do I not get left behind while the rest of my cohort gets mentioned in TechCrunch?”

That’s status anxiety. That’s urgency. That’s insecurity. That’s gold.

And that’s what shapes our cold email tone. Because now we can lead with:

“You’re building something real—but GPT doesn’t mention you. That’s a problem. Let’s fix that.”

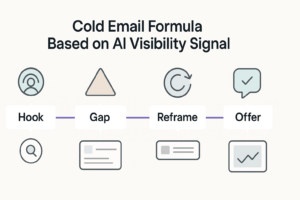

The Cold Email Formula (Based on Signal, Not Scripts)

We do use a framework internally. It’s simple, but powerful:

Hook: Reference what the buyer already asked AI.

Gap: Point out where the answer failed them.

Reframe: Offer a better way to think about the problem.

Offer: Give them something to react to—a screencast, teardown, visibility report.

But here’s the catch: we don’t write it like a formula.

We write it like a colleague. Like someone who’s already read the same prompts they did. Like someone who gets the stakes.

Here’s what that sounds like:

“We asked Claude how AI companies should be running PR in 2025. The answer was useless—fluff from 2021, and generic advice. Here’s how we’re helping brands show up where buyers actually search: GPT, Perplexity, and investor prompts. Want a screencast?”

No feature dump. No fluff. Just insight, positioned at the exact point of confusion.

Each email has one job: create momentum

We never try to do too much in one email.

If you need to prove value, give context, ask for time, and handle objections all in 4 paragraphs—you’ve already lost.

Each email we write has a single goal: get the reader to think differently. That’s it.

Sometimes that means calling out a broken assumption.

Sometimes it means showing them what GPT says about their brand (and what it doesn’t say).

Sometimes it means reframing how they evaluate vendors.

But always, always—it creates movement. Forward, not sideways.

When you write from signal, you don’t have to push

The reason most cold emails feel pushy is because they’re disconnected from buyer reality.

They’re pitching without permission. Educating without context. Selling into a vacuum.

But when you write from signal—from queries, prompts, and real-time visibility data—you’re not pitching. You’re responding.

You’re the only one in their inbox who already knows what they’ve been thinking about.

And that’s why they reply.

In the next section, we’ll show you how we operationalize this: how we take these signal-driven angles and build full-funnel, scalable outbound campaigns around them using tools like Clay, multi-touch sequencing, and AI-powered personalization that actually lands.

Ready to build a campaign that scales without losing signal?

Building the Campaign

So now you’ve got signal. You’ve seen what buyers are asking. You’ve identified the narrative gaps. You’ve built angles that don’t feel like pitches—they feel like clarity. Now comes the part most teams fumble: campaign execution.

Most cold outreach systems break down not because the message is wrong—but because the infrastructure sucks.

They don’t know who they’re emailing, how to tailor messaging by persona, or how to deploy at scale without killing deliverability.

We do. And it starts with treating every cold email like a strategic asset, not a volume play.

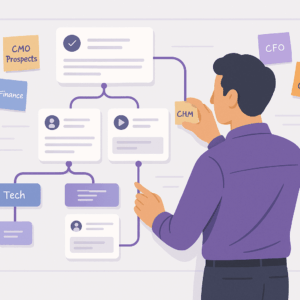

We use Clay to build segmented, AI-enriched lead lists that match the angle—not just the ICP

If you’re still buying lists based on job titles and industries, you’ve already lost.

Let’s say you built a killer angle around what GPT says about compliance gaps in cloud-based healthcare platforms. That angle is useless if your list is just “CTOs in healthtech.”

We don’t just pull titles—we pull evidence.

We use Clay to enrich every lead with signals like:

- Technologies used (Is this company using AWS? Are they listed as HIPAA-compliant vendors?)

- Press coverage (Did they recently raise funding? Launch a new product?)

- LLM relevance (Do they show up in GPT answers already—or are they absent?)

Now our cold email isn’t just “relevant to the role.”

It’s written for what this company is doing this month.

That’s the difference between ignored and bookmarked.

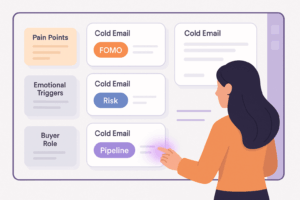

We map each persona to a signal-based story

Different buyers need different stories—even inside the same company.

The CMO cares that they’re invisible in GPT. The CTO cares about risk exposure. The RevOps lead cares about time-to-implement. So even if we’re selling the same offer, we frame it three ways.

Let’s take an angle like:

“We asked ChatGPT who solves . You weren’t there.”

To a CMO, that becomes:

“Your category is being defined—without you.”

To a CTO:

“The solution GPT recommends? Not secure. Not scalable. Here’s why.”

To RevOps:

“AI engines are telling your buyers what to think before your SDRs ever show up.”

Same signal. Different slice.

That’s how we get past the “not relevant” reflex that kills most cold outreach.

We write 3–5 part sequences with depth, not fluff

Each campaign has a heartbeat. It’s not a bunch of throwaway follow-ups asking if someone saw the email. It’s a sequence—with purpose.

Email 1: Lead with signal. Hit the confusion they’ve already felt.

Email 2: Clarify the consequences of staying confused.

Email 3: Show how others fixed it (case study, teardown, visibility report).

Email 4: Make it visual—drop a screencast or a real AI prompt example.

Email 5: Final CTA—zero pressure, just proof.

These aren’t emails written for clicks. They’re written for intelligent buyers who need to make real decisions with real consequences.

We’ve had prospects forward these emails to their entire team. Not because they felt sold to—but because they felt understood.

We use AI to write dynamic first lines—but only when they’re earned

Let’s get one thing clear: “Hey , saw you went to ” is not personalization. It’s laziness dressed as tech.

Our AI-written first lines aren’t trivia. They’re friction hooks.

They reference the thing your buyer was already thinking about before you emailed.

Like:

“I saw your Series A just closed. Wondering if Perplexity’s still recommending the wrong vendor for your stack…”

Or:

“GPT says your competitors are leading ADA compliance. You’ve got the product—but not the visibility. Let’s fix that.”

You can’t fake this level of relevance.

That’s why we use AI only after the angle is right—and the signal is strong.

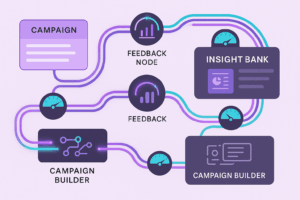

Everything flows into a single campaign tree: signal → persona → angle → copy → CTA

We document the entire flow like a logic tree.

One signal might lead to three angles. One angle might power five variations—each mapped to a persona, buying stage, or trigger condition.

This isn’t spray-and-pray. It’s sniper fire.

It lets us scale without losing nuance. It lets junior SDRs deploy enterprise-grade sequences without guesswork. It lets clients plug into a system that’s already pre-wired for buyer psychology.

That’s the difference between a campaign that sends—and one that performs.

In the next section, we’ll show you exactly how we deploy these campaigns at scale without destroying inbox reputation or landing in spam hell. Domain rotation, volume control, reply logic, warm-up flows—everything.

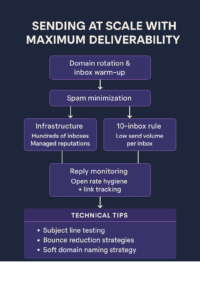

Sending At Scale With Maximum Deliverability

It doesn’t matter how good your cold email is if it never hits the inbox.

This is the part of outbound that most people underestimate—or straight-up ignore. They spend weeks crafting angles, loading personalization tokens, and running email sequences through copy critiques… then fire off 400 messages from a brand-new domain.

And just like that, they tank their sender score.

We’ve seen agencies lose entire client accounts because they didn’t know how to handle infrastructure. So when we talk about sending at scale, we’re not talking about automation. We’re talking about precision engineering.

Cold email deliverability in 2025 is not just about avoiding spam—it’s about protecting the entire system you’ve built.

We Build a Warm, Distributed Sending System—Not a Single Blast Machine

We don’t send from one inbox. We don’t even send from one domain. We create networks—small, controlled sending units that behave like human operators.

Every campaign runs across 10+ inboxes, each with:

- A unique subdomain

- A warm-up history (3–4 weeks minimum)

- Slightly varied signature structures

- Behavior patterns that mimic real usage—opens, replies, forwards

Each inbox sends under 40 emails per day. That’s it.

Why? Because volume kills trust. And trust is the only currency inboxes care about.

This approach lets us scale campaigns to 1,000+ contacts a week without ever spiking alerts.

We Rotate Domains And Use Soft Naming That Signals Legitimacy

Instead of one branded domain doing all the work (e.g., optimum7.com), we spin up:

- outreach.optimum7.ai

- visibility.optimum7.com

- research.optimum7.io

These domains sound legit because they are. We give each of them a sending role, warm them up properly, and monitor every bounce, click, and reply like it’s a stock ticker.

We also use a mix of human names across inboxes. No fake personas. No cartoon avatars. Just real-sounding names with clear signals of expertise.

When someone replies, they’re replying to a strategist—not a robot.

Subject Lines Are Not Sales Hooks—They’re Curiosity Anchors

People love to overthink subject lines. We don’t.

We treat them like headlines for a conversation your buyer already wants to have.

Some of our best-performing subject lines aren’t cute. They’re direct:

- “What Claude says about your category”

- “GPT thinks your competitor owns the space”

- “What your buyers are hearing from AI engines”

They get opened because they create a knowledge gap.

The reader doesn’t feel like they’re getting pitched. They feel like they’re about to learn something the rest of the market doesn’t know yet.

That’s the power of signal-based subject lines—they pull, they don’t push.

We Track What Matters—Without Triggering Spam Filters

Most teams blow up deliverability by stuffing emails with links, tracking pixels, and CTAs in bold red text. That’s what Google’s filters are trained to kill.

We keep links minimal. We use branded domains. And we structure replies so the primary CTA is a conversation—not a click.

Instead of:

“Click here to book a meeting on my calendar!”

We write:

“Want me to send over the teardown we ran for a client in your space?”

Then, only after they reply, do we offer a booking link or resource.

That keeps engagement real, not manufactured. And it boosts your domain health over time.

The System Monitors Everything—Quietly, In The Background

Our team tracks:

- Open rates by inbox and domain

- Bounce patterns

- Positive reply sentiment

- Negative signals (spam flags, unsubscribes)

- Domain health scores across 3 providers

When an inbox dips below a threshold, it’s paused automatically.

When a domain needs cooling, we shift traffic elsewhere.

No firefighting. Just proactive email health management.

The result?

Campaigns that run for months.

Angles that keep earning replies.

Deliverability that stays bulletproof, even as volume scales.

Your competitors are still nuking their sender scores with every new product launch.

You’ll be sending smart, sharp emails from clean domains that land right where they should: in the primary tab, next to the emails that actually get read.

Lead Routing And Conversion Layer

If your cold outreach is working, you’re going to get responses. Some of them excited. Some skeptical. Some asking for more info. And yeah—some telling you to go away.

What you do with those replies determines whether your outbound system actually drives revenue or just fills a spreadsheet with “interest.”

A reply is not a win. It’s a signal.

And unless you’ve built a clean, responsive layer to route, tag, and convert those signals—you’re leaving deals on the table.

This is where most outbound ops fall apart. Ours doesn’t.

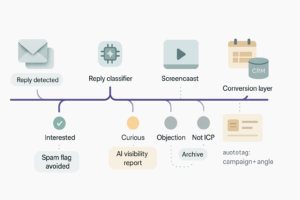

We Classify Every Reply With Context, Not Keywords

We don’t treat replies like raw data. We treat them like human signals that require human context.

An “interested” reply from a mid-market CTO is not the same as one from a freelancer looking to pick your brain. So we run every reply through a logic layer that classifies based on tone, persona, and intent—not just keyword triggers.

Here’s how we categorize in practice:

- Interested: Clear buying intent or meeting request

- Curious: Engaged, but not committing—“Send me more info,” “This is interesting”

- Objection: Pushback, skepticism, or concern about timing, pricing, etc.

- Not ICP: Wrong persona or disqualified account

- Spam/Abuse: Auto-replies, hard rejections, bad faith

That means we don’t treat “Send me something” as a green light. We treat it as a fork in the road—a chance to deepen the conversation or disqualify fast.

We Train SDRs To Respond Like Strategists, Not Robots

Templates are helpful—but only when they feel like real people wrote them.

When someone replies, “Can you send more details?” our SDRs don’t shoot back a one-pager and cross their fingers. They reply with something like:

“Happy to. But to make it useful, can I ask—were you more curious about how AI visibility works, or how it ties into your current funnel?”

That kind of response does two things:

- It humanizes the exchange

- It steers the lead toward a qualified outcome

We don’t let curiosity fizzle into silence. We turn it into momentum.

We Use Screencasts And Mini-Reports To Push The Conversation Forward

Not everyone is ready for a sales call. That’s fine. But that doesn’t mean you just say “let me know.”

We use what we call “conversion artifacts”:

Short, tactical content designed to make the buyer feel seen—and to prove we’ve done the homework.

That might be:

- A custom screencast showing what GPT says (or doesn’t) about their brand

- A 1-page AI Visibility Summary specific to their category

- A teardown of their competitor’s presence in Claude vs. Perplexity

This isn’t fluff. It’s ammo. And it earns trust fast.

One founder replied to a follow-up with, “This is the first cold email I’ve gotten that actually taught me something.”

He booked a call the next day.

That’s what happens when you don’t just ask for time—you deserve it.

Booking Flows Are Seamless—No Friction, No Waiting

When someone’s ready to talk, we don’t make them jump through hoops.

Our SDRs offer immediate options:

- A Calendly link with flexible slots

- A “send us 3 times” fallback

- Or a direct handoff to the AE or strategist in the reply thread

Everything is logged. Everything is tracked. Everything flows straight into CRM with context, persona, and campaign tag already applied.

There’s no manual lead routing. No duplicate records. No mystery about what the original angle was.

The moment someone replies, we know:

- What campaign got their attention

- Which persona the message was built for

- What signal triggered their interest

That means our closers walk into every meeting with full narrative alignment. No guesswork. No generic decks. Just continuity and confidence.

There’s a reason our campaigns don’t just get opens and replies.

They get meetings that convert.

Because we’ve engineered every step of the funnel—from the prompt the buyer typed into GPT… to the email that hit the right nerve… to the SDR who knew how to steer the reply… to the booked call that felt like a continuation, not a restart.

Optimization Loop And Learning System

You don’t scale cold outreach by sending more emails.

You scale by learning faster than everyone else.

Most outbound teams run like slot machines: load contacts, pull levers, wait for luck. When something doesn’t work, they either blame the list or rewrite the copy. Then repeat. No system. No pattern recognition.

Our approach is different. Every campaign is an experiment. Every reply is a data point. And every week, we refine not just the messaging—but the model itself.

Because the truth is, buyer behavior changes.

AI search patterns shift. Prompts evolve.

And if you’re not learning in real time, your outbound decays—fast.

We Run Weekly Outbound Reviews Like Mission Debriefs

Every campaign runs on a tight feedback loop.

Every Friday, we sit down—not to “check metrics”—but to ask one question:

What are buyers trying to tell us this week?

Here’s what we look at:

- Which angles drove the most replies?

- Which sequences lost steam after Email 2 or 3?

- Which inboxes are underperforming or getting flagged?

- What objections are showing up more frequently?

- Which persona-role combos are converting best?

It’s not just about the emails. It’s about buyer psychology. What’s shifting? What’s fading? What’s heating up?

That level of reflection makes us sharper. It also makes us faster to pivot when an angle dies or a market conversation flips.

We Analyze Reply Sentiment, Not Just Reply Count

A 20% reply rate means nothing if half the responses say “not interested” or “unsubscribe.”

We tag every reply with human sentiment—positive, neutral, negative, or unknown.

This helps us see not just who’s replying, but how they feel about the angle.

Some messages generate curiosity. Others generate frustration. That tells us where we’re hitting too hard—or not hard enough.

We also track first-response velocity—how fast someone replies after opening.

If an email gets a 12% reply rate but 80% of those come within 15 minutes, we know we hit something urgent.

That becomes our new benchmark.

We Loop Wins Back Into The Visibility Report

When an angle crushes, we don’t just celebrate. We reverse-engineer it.

Let’s say we ran a campaign with the line:

“We asked GPT how to get AI PR that moves pipeline—not headlines. You weren’t in the answer.”

And it pulls a 44% open rate, 16% positive replies, and $80K in pipeline in 30 days.

We go back to the AI engines and trace the prompts again:

- What else are buyers asking in that category?

- Are competitors starting to show up in new ways?

- Can we double down with screencasts, reports, or event-triggered follow-ups?

It becomes a feedback loop.

The outreach sharpens the signal.

The signal informs new outreach.

And suddenly, you’re not doing cold email anymore.

You’re doing live-market narrative engineering—on a loop.

We Watch For Narrative Drift Before Performance Drops

Every message has a shelf life.

The moment buyers start asking new questions—or stop responding to the old ones—you’re on borrowed time.

That’s why we run narrative drift checks.

We reload queries into GPT, Claude, and Perplexity to see how the answers have evolved.

Has a competitor started getting mentioned more?

Has a new pain point emerged in the way buyers phrase questions?

Are AI engines using different framing, tone, or sources?

We compare fresh prompt outputs to the original campaign intel.

If the language has shifted, we shift the narrative—before performance drops.

No lag. No guessing. Just proactive control.

This is why our clients stay ahead of the market.

Because we don’t write email campaigns. We build systems that learn.

The difference between a good month and a record quarter isn’t volume—it’s velocity.

How fast can you extract insight from signal?

How fast can you pivot when buyers shift direction?

How fast can you turn that shift into a better hook, a smarter offer, a tighter close?

That’s the loop. That’s the system.

That’s how you win.

Ready to see it all in action? Up next: the full case study breakdown—how Optimum7 used this exact system to sell AI PR with AI signals, and booked real revenue in less than 45 days.

Case Study: How Optimum7 Used AI Signals To Sell AI PR

When we decided to launch Optimum7’s AI PR offering, we faced a positioning challenge. The service was new, the category was undefined, and founders weren’t actively searching for “AI visibility strategy” or “LLM reputation management.”

Instead, they were stuck in outdated assumptions about PR: press mentions, media lists, and hoping coverage leads to awareness. But the actual buyer behavior told a different story.

We tapped into our own AI Visibility process to see what questions AI startup founders were really asking—and what answers ChatGPT, Perplexity, and Claude were giving them.

What The Market Was Asking AI

Across multiple large language models, we pulled hundreds of buyer prompts from actual users in the AI startup space. These were the real, high-intent questions being asked by founders, heads of marketing, and growth operators in the wild:

- “How do I get visibility as an AI startup?”

- “Best ways to stand out in the generative AI space?”

- “How do AI companies build credibility before product launch?”

- “Do investors care about press mentions?”

- “Is it possible to show up in ChatGPT search results?”

What we found in the responses shocked us.

Most of the output was vague, outdated, and recycled from generic startup playbooks. No mention of AI engines. No talk of decision loops inside GPT. And absolutely nothing about performance-based PR or LLM-based citation strategies.

Even for queries like “How do I get visibility as an AI founder?”, the top-cited sources were:

- 2021 blog posts

- Generic VC advice threads

- Legacy PR firm websites (Edelman, BCW, etc.)

Our competitors were showing up—not because they were relevant, but because they were old and indexed.

We had the right offer. The market just couldn’t see it. Yet.

What We Sent And Why It Worked

We built a cold outreach campaign anchored entirely in what we saw buyers already searching.

Here’s the opening line from the best-performing email:

“We asked ChatGPT how founders should build visibility for their AI startup. The answer? Useless—fluff from 2021, plus a list of PR firms that haven’t mentioned AI in over a year. Here’s what your buyers actually see when they ask GPT about you.”

The key wasn’t creativity—it was accuracy. This email spoke directly to the confusion the buyer had just experienced. It didn’t try to explain AI PR. It exposed the problem they hadn’t yet put into words: visibility through traditional PR doesn’t translate into modern AI engines.

In follow-ups, we included:

- Screenshots from GPT and Perplexity showing what did and didn’t appear when buyers searched

- Custom screencasts showing visibility gaps in their category

- Real examples of how LLMs frame competitors—sometimes inaccurately, but persuasively

The email sequence didn’t pitch. It diagnosed. And it earned trust fast.

Campaign Results

This campaign wasn’t hypothetical—it ran across multiple inboxes over a 4-week window in Q1 2024. Here’s what it produced:

- Open Rate: 44%

- Positive Reply Rate: 16%

- SQLs Booked: 12 sales-qualified calls

- Pipeline Generated: $80,000+ in monthly recurring revenue (MRR)

- Time to First Close: < 21 days from initial email send

All of this came from zero paid traffic. No ads. No media buys. Just outbound rooted in buyer behavior that LLMs exposed in plain sight.

Why It Converted

We didn’t just explain a new category—we showedi the prospect that the category already existed.

The second they saw GPT’s answer to “How do I get visibility as an AI company?”, and realized they weren’t mentioned—or worse, that competitors with weaker offerings were—they understood the stakes.

The emails created urgency not by pushing, but by revealing:

“You’re not showing up where your buyers search. We can fix that.”

That’s not a pitch. That’s a wake-up call.

This campaign became a proof point for our entire methodology.

It showed that AI signal wasn’t just insightful—it was monetizable.

It proved that buyers don’t need to know what your product is called… they just need to see that you understand their invisible friction better than anyone else.

That’s how we sold AI PR—by using AI engines to tell the story for us.

Want to see how this system can be deployed for your category? Next: how to package, productize, and sell this as a full-blown demand generation engine for your agency or internal sales team.

Systemize This For Your Company Or Agency

The beauty of this model is that it’s not tied to one brand or category. It works because it’s built around universal buyer behavior—asking AI engines to solve problems before talking to humans.

And once you understand how to turn those prompts into signal, and that signal into sales conversations, you can package this system for just about any B2B niche. SaaS. Services. Compliance. Infrastructure. Emerging tech.

It’s not “cold email.” It’s signal-first outbound infrastructure. And it’s teachable.

Tier 1: Cold Email Only

At the most basic level, this system works as a cold email product.

You run the AI Visibility scan internally, pull the prompts, write 3–5 signal-driven sequences, and send from a clean infrastructure.

This tier is great for:

- Productized services (fractional CMO, compliance audit, CRO teardown)

- Small agencies testing outbound before building a full SDR team

- Startups with narrow ICPs and strong founder-led sales

You’re not promising leads. You’re offering signal-matched visibility in your prospect’s inbox.

Tier 2: Email + AI Visibility Report Bundle

The next tier is where things get sticky. You don’t just write emails—you hand the client a report that shows what buyers see when they search via AI engines.

That means:

- Prompt breakdowns by category

- Competitor citation heatmaps

- Query clusters by persona

- Content/visibility gaps

- Recommendations for campaign angles and landing page narratives

This turns your team into narrative engineers, not just email copywriters.

Clients love this because it teaches them something they can’t see from analytics. It also helps their internal teams (especially RevOps and Product Marketing) align messaging to real buyer friction.

Typical service range: $8K–$12K/project or $6K+/month retainer.

Tier 3: Full Demand Engine Powered By Visibility Signal

This is the gold tier. You don’t just build the campaign. You plug into the full sales and marketing system with:

- Cold email

- AI Visibility Reporting

- Narrative-based website rewrites

- Sales enablement: talk tracks, follow-up emails, pitch decks

- Screencast and teardown automation

- CRM tagging and lead scoring logic based on signal strength

In this model, you’re not offering outbound. You’re offering category control.

You help the client dominate what buyers see when they ask AI questions in their space. You feed those insights back into their team. You become indispensable.

This is where you build $20K–$30K/month retainers—or sell packaged strategy + execution in blocks of $50K+.

Train Your SDRs To Sell It With One Simple Offer

If you want to put this into your outbound team tomorrow, use this CTA:

“Want us to run a free visibility simulation and show you what your buyers see when they ask AI about your category?”

That one line has booked more meetings than any pricing or value proposition slide we’ve ever used.

Because it bypasses skepticism.

It cuts straight to curiosity.

And it gives your prospect a taste of what you’ll later deliver with precision.

The infrastructure’s not hard. The tools are available. The workflows are repeatable.

What matters is that you shift your mindset: stop selling services.

Start selling the clarity buyers can’t find anywhere else.

And in 2025, clarity is everything.

The Signal-First Sales Manifesto

Cold email isn’t dead. But generic cold email is buried six feet deep, and Google, Microsoft, and every buyer with a brain helped dig the grave.

What used to work—the copywriting hacks, the personalization gimmicks, the “quick question” subject lines—is now either filtered, ignored, or laughed at in Slack screenshots. And good. That noise deserved to die.

But what’s rising in its place is smarter, sharper, and more aligned with how modern B2B buyers actually behave.

Not how sales teams wish they behaved.

Not how your outdated sequences pretend they behave.

But how they move right now—inside LLMs, prompt-first, before they ever hit your website or talk to your reps.

That’s what this system is built on: signal, not assumptions.

You don’t need to guess what your buyers care about. You can see what they’re asking ChatGPT. You can see who gets mentioned. You can see which competitor’s story is being told—and which part of the funnel you’ve already lost before you even send the first email.

Cold outreach that ignores this is already obsolete.

What wins in 2025 and beyond is outbound that reflects reality:

- Reality in the questions buyers ask AI

- Reality in how those AI engines frame your category

- Reality in which vendors get named—and which get erased

- Reality in the emotional friction your buyers can’t Google away

When your cold email reflects that reality, it doesn’t feel like spam. It feels like insight.

It earns attention. It starts conversations. It drives revenue.

So no—we’re not giving up on cold outreach. We’re rebuilding it.

Smarter. Leaner. Visibility-driven. And tuned to the psychology of modern B2B decisions.

This isn’t just sales ops. This is category warfare—and signal is your unfair advantage.

Want To See Your AI Visibility Score?

Let’s show you exactly what your buyers see when they ask GPT, Claude, or Perplexity about your product, your space, or your competitors. We’ll run the queries. We’ll build the report. And we’ll tell you what to do next.