When B2B Checkout Meets Old-School Credit

The order looked like a win. A longtime customer dropped a $120,000 purchase into the portal—replacement pumps, hoses, and fittings—all on their usual net 60 terms. The system accepted it instantly, just like a consumer checkout would. Confirmation email sent. Everyone is happy.

Except there was a problem. The account was already over its credit limit. Finance didn’t catch it until days later, buried in reconciliations and spreadsheets. By then, production had already scheduled the order, the warehouse had started picking, and the customer assumed everything was moving forward.

What happened next was chaos. Finance threw up roadblocks, sales tried to patch things over with nervous smiles, operations yanked the order midstream, and the buyer suddenly felt ambushed. A single big order dissolved into a blur of ringing phones, half-meant apologies, and negotiations that felt more like damage control than business.

This is what happens when Shopify’s standard checkout—designed for credit cards and consumer transactions—gets stretched into the world of B2B credit. There’s no native way to enforce account-specific credit limits. No automatic stop when balances run high. No built-in approval chain when orders exceed thresholds. The result is exposure: financial risk for the supplier, frustration for the buyer, and hours of manual cleanup for everyone in between.

In industrial trade, credit isn’t a nice-to-have. It’s the backbone of how deals are done. Net 30, 60, and even 90 terms aren’t perks; they’re table stakes. But unless your portal can manage those terms as intelligently as it handles pricing or inventory, you’re flying blind.

That’s where automated credit management changes the game. Instead of hoping finance catches the gaps, the portal itself enforces the rules. Orders flow until limits are reached. Approvals kick in when they should. Balances update in real time. Buyers keep ordering with confidence, and suppliers stop taking on hidden risk.

Why Credit Terms Are Non-Negotiable in B2B Supply

In consumer e-commerce, payment is simple. You swipe a card, click “Pay Now,” and the transaction is done. But industrial supply doesn’t work that way—and it never has.

Large orders aren’t impulse buys. They’re tied to production schedules, project budgets, and approval hierarchies that don’t move overnight. Procurement departments expect flexibility because their own cash flow depends on it. That’s why net 30, 60, or even 90-day terms are the rule, not the exception.

Credit isn’t just a payment method. It’s trust, extended in both directions. When a supplier offers credit terms, they’re saying, “We believe you’ll pay us later because we know your operation, we know your reliability, and we want this relationship to last.” Buyers, in turn, choose suppliers who give them breathing room. A competitor who demands prepayment looks rigid. The supplier who extends terms looks like a partner.

But here’s the paradox: the same credit that builds loyalty can destroy margins if it isn’t controlled. An account that quietly stacks up unpaid balances becomes a financial liability. A single order that sneaks past the limit puts both supplier and buyer in an awkward, sometimes adversarial position. The sales team celebrates the win; finance sees a red flag. Operations, caught in the middle, struggles to figure out if the order should even ship.

For manufacturers and distributors, offering terms isn’t optional. Pull them away, and buyers walk. But offering them without structure is a gamble. And in industries where contracts are measured in millions, a gamble on credit can turn into a loss too big to absorb.

That’s why credit terms have to be managed as deliberately as pricing or inventory. They’re not an “add-on.” They’re the foundation that holds industrial trade together.

The Problem with Shopify’s Native Checkout for B2B Credit

Shopify’s checkout is elegant, fast, and efficient—but it was built for consumers, not industrial buyers. It assumes every transaction is settled on the spot. Credit cards, PayPal, maybe ACH. Swipe, confirm, done. For B2C, that’s perfect. For B2B, it’s a mismatch.

Here’s where the cracks appear.

A buyer places a $50,000 order on net 60 terms. Shopify’s standard checkout doesn’t know anything about that account’s credit limit. It also doesn’t recognize negotiated payment terms, leaving both buyers and finance teams exposed when orders slide through unchecked. It can’t see whether the customer already has $200,000 in unpaid invoices. It won’t stop the order when balances are overdue. It just processes the transaction as if nothing is wrong.

There’s no approval workflow either. If an order pushes a buyer past their credit threshold, nothing in the native flow asks for a manager’s sign-off or finance review. The order slides straight through, leaving finance to scramble days later when they realize exposure is higher than it should be.

Balances? Shopify doesn’t track them natively. A customer with four open invoices sees nothing at checkout that reflects their true standing. They might believe they have plenty of room to order—until the AR team has to call and explain otherwise. That conversation rarely ends well.

This is where suppliers start patching the gaps with manual workarounds. Spreadsheets to track credit limits. Email chains for approvals. Finance clerks reconciling balances after the fact. It’s clumsy, it’s slow, and it’s dangerous. Because while the storefront looks modern, the credit process behind it feels like the 1990s—full of paper trails and human error.

And that’s the paradox for industrial manufacturers on Shopify Plus. You’ve got a world-class ecommerce engine on the front end, but when it comes to credit—the lifeblood of B2B trade—the foundation is missing.

The Risks of Manual Workarounds

Everyone thinks a spreadsheet will hold things together—until it doesn’t.

At first, it feels harmless enough. Finance keeps a running list of who owes what. Sales checks it before pushing big orders through. Operations knows which accounts to watch closely. The system isn’t pretty, but it “works.”

Until one day it doesn’t.

A customer who’s already two months behind on a big invoice slides another order through the portal. Nobody notices right away — the spreadsheet was last updated three days ago. Production schedules it. The warehouse starts pulling stock. By the time finance catches it, the order is halfway out the door. Now the company has a decision to make: do you stop the shipment and risk burning the relationship, or do you send it and pray the money comes in? Neither choice feels good.

And it’s never just one order. Spreadsheets get out of sync. Two people edit the same file, each thinking they’ve got the latest numbers. A balance looks fine on one sheet and overdue on another. Sales reps spend hours trying to untangle which version is right—time they should’ve spent selling.

Meanwhile, buyers feel the cracks. They place an order and hear nothing for days. Or worse, the order gets held up without explanation because someone internally flagged their account as late. What was supposed to be a seamless portal experience turns into a series of awkward phone calls.

That’s the real risk of manual credit control. It’s not just messy data—it’s the trust it quietly erodes. Internally, your team stops believing the system. Externally, your customers start questioning whether you can keep up with their needs. And in B2B, once confidence slips, it’s hard to win it back.

What Industrial Buyers Expect from Credit-Driven Portals

Buyers aren’t looking for bells and whistles. They don’t care if your checkout has the latest design trend or clever copy. What they care about is whether the portal reflects how their business actually runs.

For industrial clients, credit isn’t a feature—it’s part of the job. A plant manager ordering replacement pumps expects the system to respect the company’s net 60 agreement. A procurement officer logging in wants to see exactly how much credit remains before hitting the limit. Nobody wants to place a six-figure order only to find out days later that it’s been put on hold because of an unseen balance issue.

What they expect, above all, is transparency. When they check out, they want to know three things:

- What’s my current limit?

- What’s my outstanding balance?

- Do I have room to place this order without delay?

If the answers aren’t visible, they feel like they’re ordering blind. And ordering blind is a fast way to lose trust.

They also expect speed. If an order does push them over the limit, buyers don’t want to wait a week for finance to manually review it. They want a clear approval path—a notification to the right manager, a click-to-approve workflow, and an answer within hours, not days. The smoother the approval process, the more confident they feel in using the portal for real orders instead of defaulting to email and phone calls.

And finally, they want self-service. If there’s a balance to pay down, they want to handle it inside the same portal. No separate calls to AR, no offline paperwork, and no chasing down statements. Just log in, review invoices, settle up, and keep ordering.

When a portal delivers that experience, it stops being just a storefront. It becomes an extension of the buyer’s own workflow—a tool that reduces headaches instead of adding to them.

The Blueprint for Automated Credit Management in Shopify Plus

Imagine a buyer logging into your Shopify Plus portal to place a $75,000 order. With the standard setup, they’d check out like any consumer, and the system would treat it as if a credit card should be swiped. But with an automated credit engine built into the flow, the experience changes completely—for them and for you.

Here’s how it works.

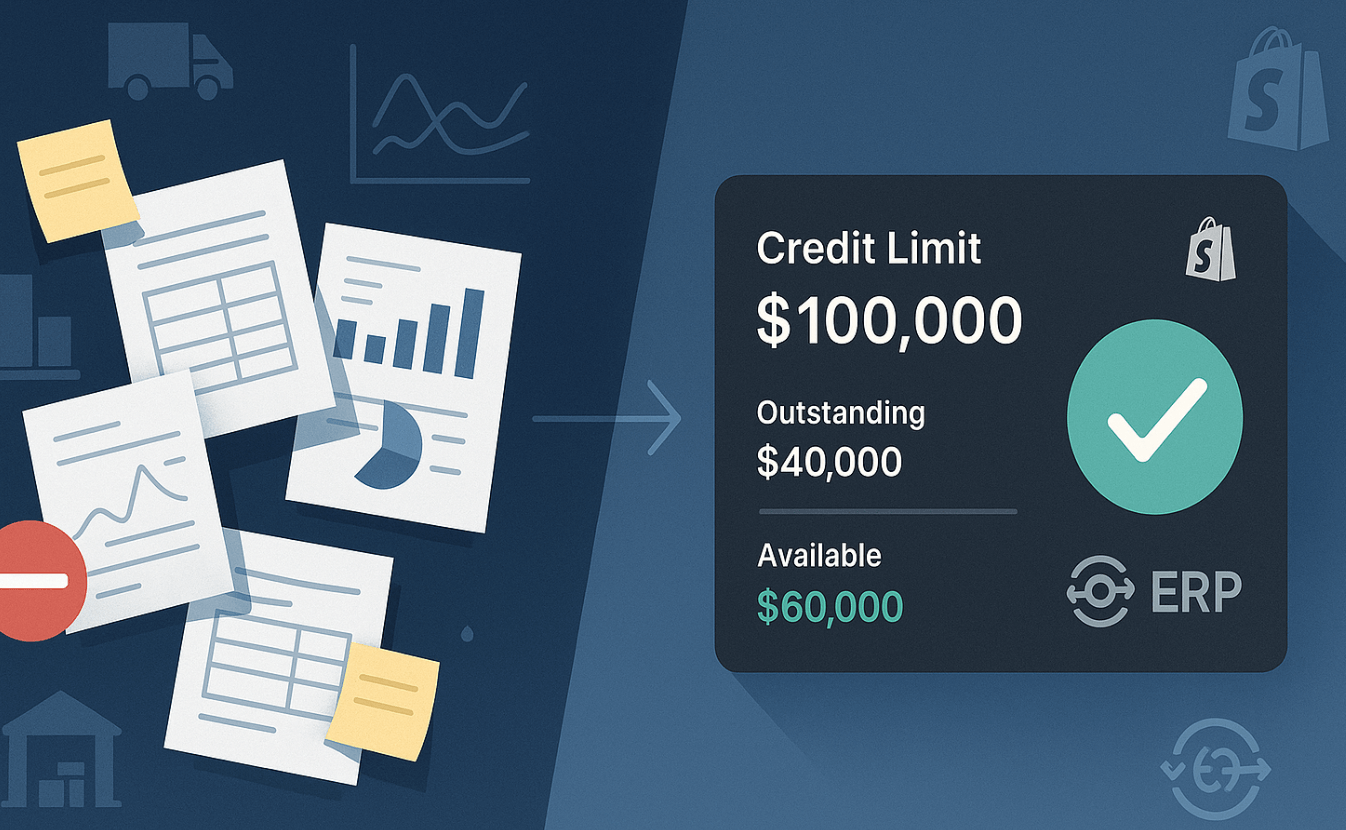

The buyer sees their available credit before they even hit the checkout button. If their limit is $100,000 and they’ve got $40,000 outstanding, the system tells them they’ve got $60,000 left to work with. If their cart pushes past that number, they don’t just get blocked. The order routes for approval automatically—maybe to a manager on their side, maybe to finance on yours, depending on the rules you’ve set.

On your end, the system is just as clear. Credit limits aren’t buried in spreadsheets or updated days later. They live inside the portal, pulling directly from ERP data, and they update in real time as invoices are paid down or balances grow. That means sales doesn’t have to chase finance for answers, and finance doesn’t have to worry about orders sneaking through unnoticed.

When the order is approved, it flows straight into ERP without a hitch. If a balance needs to be settled first, the buyer doesn’t need to pick up the phone—they can log in, pay down part of the balance online, and instantly free up credit for the order they need to place.

It’s a system that enforces credit rules and compliance requirements without slowing commerce. Buyers see clarity, finance sees control, and sales sees momentum. Nobody is left guessing. Nobody is stuck chasing. And most importantly, orders keep moving without putting the supplier at unnecessary risk.

That’s the blueprint: credit logic built into Shopify Plus so it feels invisible, automatic, and reliable — the way B2B buying experience is supposed to work.

Integrating ERP with Shopify Plus for Credit Enforcement

Every industrial manufacturer knows the truth: if ERP isn’t in the loop, the system isn’t real. Shopify Plus can handle the storefront, but the actual rules—credit limits, payment history, outstanding balances—all live inside ERP. That’s the system of record, and if your credit logic isn’t tied to it, you’re flying blind.

Here’s where the integration matters.

ERP already tracks who owes what, when terms are due, and how much exposure each account represents. The problem comes when Shopify Plus is left on its own, running checkout as if every buyer is starting from zero. That disconnect is how over-limit orders slide through unnoticed.

When the two systems are wired together, the picture changes. A buyer adds $40,000 worth of parts to their cart. Shopify checks ERP in real time: this customer has a $100,000 credit line, $75,000 already outstanding, and $20,000 overdue. Result? The system knows the cart would push them over their limit, and it triggers the right workflow. Maybe the buyer gets prompted to pay down their balance. Maybe the order routes to finance for approval. Either way, the risk doesn’t go unnoticed.

Middleware tools like Celigo, Boomi, or MuleSoft often act as the translator between Shopify Plus and ERP systems like SAP, NetSuite, Dynamics, or Epicor. They make sure data flows both ways—credit updates, payments, approvals—without waiting for end-of-day batches or manual reconciliation.

The goal isn’t to replace ERP. It’s to let Shopify Plus speak its language. Because if your portal shows one thing and your ERP shows another, buyers lose confidence and finance loses control. But when they’re aligned, everyone’s working from the same truth.

That alignment is what makes automated credit management more than a nice idea. It makes it enforceable. It makes it real.

Approval Workflows That Protect Revenue Without Slowing Sales

In B2B, approvals are unavoidable. Nobody wants a junior buyer running up a six-figure balance without oversight. But approvals are also where momentum dies. An order lands in someone’s inbox, sits for days, and suddenly the project it was meant to support is behind schedule.

That’s the trap most suppliers fall into: protect the business or keep sales moving—but not both.

Automated workflows in Shopify Plus change that equation. Imagine a requisitioner building a $60,000 order that pushes their account over the credit threshold. Instead of the order stalling in limbo, the system routes it instantly to the right approver. If the manager needs to sign off, they get a notification—inside the portal, via email, or even on mobile. One click approves, one click denies. If finance needs to weigh in, the system escalates automatically, with the buyer seeing the status the whole way.

The difference is visibility. Buyers aren’t left wondering if their order vanished. Sales isn’t left chasing signatures. Finance isn’t left uncovering surprises days later. Everyone sees where the order is, who has it, and what needs to happen next.

And because the approval logic is built on credit rules, it only triggers when it should. A customer with room under their limit checks out seamlessly. A customer over their limit triggers a workflow. Nobody is slowed down unnecessarily.

The result is a balance that industrial trade has always needed but rarely achieved: credit risk is managed, but sales momentum isn’t sacrificed. Approvals don’t feel like red tape—they feel like part of a system that keeps everyone safe and projects on schedule.

Building Trust Through Transparency for Buyers and the Credit Team

Credit gets messy when it’s hidden. A buyer places an order not knowing where their balance stands, only to get a call later that the account is frozen until payment clears. That kind of surprise isn’t just inconvenient—it makes buyers feel like their supplier is unreliable.

Transparency fixes that.

In a Shopify Plus portal with automated credit management, every buyer sees their standing before they hit “submit.” Their dashboard shows three things that matter most:

- Current credit limit.

- Outstanding balance.

- Available credit remaining.

It’s not complicated, but it’s powerful. A procurement officer looking at a $90,000 order knows immediately whether it will go through or whether it’ll need approval. No guessing, no waiting for finance to call back. If they need to free up credit, they can pay down part of the balance directly in the portal and move forward within minutes.

That clarity cuts down on disputes too. No more arguments about who said what, no more finger-pointing when invoices pile up. The numbers are live, and everyone—buyer, sales, and finance—sees the same truth.

For buyers, that transparency builds trust. They stop treating the supplier as a risk and start seeing them as a partner who keeps things clear and predictable. And in B2B, predictability is currency. Buyers return to the supplier who makes their job easier, not harder.

For suppliers, the payoff is just as big. Transparent credit management doesn’t just reduce disputes—it makes customers more comfortable placing bigger orders, because they know exactly how the system will respond.

In a world where most portals still treat credit like an afterthought, giving buyers visibility becomes a competitive advantage all on its own.

From Chasing to Control: Empowering the Credit Management Team

In most manufacturing companies, accounts receivable doesn’t feel like strategy. It feels like survival. The team spends its days chasing late payments, patching together spreadsheets, and answering the same anxious question from sales: “Can this order ship or not?” By month’s end, everyone’s drained, and the books still don’t quite add up.

The heart of the problem is timing. AR is always behind the play. A big order slips through. A balance gets missed. A credit line quietly tips over the limit. Finance hears about it afterward and scrambles to clean up the mess. Then the cycle repeats.

Shopify Plus with automated credit management flips that dynamic. Instead of reacting, AR sets the pace from the start and credit limits don’t live in hidden spreadsheets anymore; they’re enforced the moment an order comes in. Approvals don’t pile up in inboxes—they route themselves. Payments aren’t floating around disconnected from the system—they sync instantly with outstanding balances.

Suddenly, the AR desk is calmer. Reminders go out on their own when invoices come due. Buyers pay online without having to call for statements. Finance doesn’t spend nights second-guessing numbers, because the ERP and Shopify are already speaking the same language. The team that used to be stuck reconciling can finally look ahead—adjusting limits, watching risk exposure, and backing the company’s growth.

And it changes relationships, too. Instead of a buyer getting that awkward phone call about an overdue balance, they can see everything clearly in the portal. What’s owed. When it’s due. How to pay it. The tension fades, disputes shrink, and payments come in faster.

AR stops being the department people call when something breaks. It becomes the system that keeps credit flowing—steady, transparent, and safe—protecting revenue without ever putting the brakes on sales.

Competitive Advantage of Automated Credit Management

In industrial supply, everyone can sell parts. Catalogs overlap, pricing can be negotiated, and logistics are rarely unique for long. What separates one supplier from another isn’t always the product—it’s the way business gets done.

Credit is where that difference shows.

A supplier still running manual checks and email approvals looks outdated. Orders stall, buyers get frustrated, and procurement officers start wondering if the supplier can keep up with their needs. In contrast, a supplier whose portal enforces credit rules automatically, like showing limits, triggering approvals, and updating balances, feels modern, dependable, and safe.

That perception matters. When procurement teams decide where to allocate spending, they don’t just look at cost per unit. They look at reliability. They stick with the supplier who never surprises them with a hold, who never loses track of balances, and who never makes them chase answers. Automated credit management turns something most companies treat as back-office into a front-line competitive advantage.

It also shifts the sales dynamic. Instead of sales reps apologizing for delayed orders or scrambling to explain finance holds, they can focus on growth. They can walk into renewal meetings and say with confidence: “Your terms are managed automatically. You’ll never have to call us about credit again.” That level of assurance wins contracts in ways discounts can’t.

And while competitors drown in manual reconciliation, you move faster. Orders flow without hesitation. Approvals happen the same day. Financial risk stays under control. The combination of speed and trust becomes your edge.

In an industry where relationships last decades and contracts are measured in millions, being the supplier who handles credit flawlessly isn’t just operationally smart. It’s strategically unbeatable.

B2B Credit Playbook: Rules, Workflows & Guardrails

Credit Readiness Audit (Pre-Build Checklist)

Get your house in order before you wire anything.

| Checkpoint | Why It Matters | Status |

| Credit policy documented by segment (limits, terms, grace rules) | Engineers can’t encode what finance hasn’t defined | ☐ |

| Per-account limits & terms mastered (ERP is the source of truth) | Avoids “Shopify says X, ERP says Y” conflicts | ☐ |

| Aging buckets + dunning rules (30/60/90/120) | Drives automated holds and approvals | ☐ |

| Exception rules defined (VIP, project exceptions, retainage) | Prevents ad-hoc overrides that break trust | ☐ |

| AR visibility requirements (who sees limits/balances) | Sets role-based permissions in the portal | ☐ |

| Approval SLAs agreed (e.g., 4h manager, 24h finance) | Without SLAs, approvals become bottlenecks | ☐ |

How to use: Finance owns this. If any row is blank or “we’ll decide later,” pause the project. Credit logic fails when policy is fuzzy.

ERP ↔ Shopify Plus Integration Map

One truth. No spreadsheets. No surprises.

| Data Object | Source | Dest | Sync Cadence | Owner | Failure Handling |

| Credit Limit (per account) | ERP | Shopify | Real-time or hourly | IT/Integration | Hard stop on stale data; alert finance |

| Outstanding Balance | ERP | Shopify | Real-time or hourly | IT/Integration | Disable new orders if > 24h stale |

| Available Credit (limit − open AR − in-flight orders) | Calculated | Shopify | Real-time | IT/Integration | Recalculate each page load |

| Invoices & Aging | ERP | Shopify | Hourly/daily | AR Ops | Mark overdue status in portal |

| Order Approvals (status, who, when) | Shopify | ERP | Real-time | Finance | Log immutable audit trail |

| Payments (pay down, partials) | Shopify → PSP | ERP | Real-time | AR Ops | Auto-release credit on capture |

How to use: Don’t go live without clear owners and failure behavior. Use middleware (Celigo/Boomi/MuleSoft) if needed. Assume outages; design for safe defaults.

Pilot, Cutover & KPIs

| Phase | Timeline | Focus | Notes |

| Shadow Mode | Weeks 1–2 | Run approvals/holds silently (no blocking) | Validate logic before impact |

| Soft Enforce | Weeks 3–4 | Holds + approvals active (finance backstop) | Train sales/AR in parallel |

| Full Enforce | Weeks 5–6 | Full rollout with live holds/approvals | Publish buyer FAQ |

Credit Rules & Approval Workflow

A. Core Rules (Checklist)

| Rule | Action | Status |

| Within limit & current | Auto-approve | ☐ |

| ≤10% over limit | Route to mgr + finance | ☐ |

| >10% over / 60+ days overdue | Hard hold, pay-down required | ☐ |

| Large order >$100K | Finance approval | ☐ |

| Deposit received | Partial release | ☐ |

B. Routing Matrix

| Trigger | Approver(s) | SLA | Escalation |

| Grace band | Mgr → Finance | 4h / 24h | Sales @2h |

| Overdue invoices | Finance | 24h | AR Dir |

| Large order | Finance + Sales | 24h | CFO >$250K |

C. Visibility

| Role | Must See | Status |

| Buyer | Limit / Balance / Status | ☐ |

| Sales | Buyer view + reason codes | ☐ |

| Finance | Full audit + invoices | ☐ |

D. SLA Scorecard

| Metric | Target | Pilot | Status |

| Manager Approval | <4h | ___ | ☐ |

| Finance Approval | <24h | ___ | ☐ |

| Auto-Approvals | >85% | ___ | ☐ |

Go-Live Rule: If rules aren’t automated or SLAs missed in pilot, pause cutover.

Success KPIs

| KPI | Target |

| Orders shipped over limit | 0 after cutover |

| Manager approval turnaround | < 4h |

| Finance approval turnaround | < 24h |

| % Orders auto-approved | > 85% |

| Portal invoice payments | +30–50% adoption |

| Credit disputes | −50% in 60 days |

Credit as the Backbone of B2B Growth

Industrial commerce doesn’t run on one-off payments. It runs on trust stretched across weeks or months—credit extended so buyers can keep production moving while suppliers wait to be paid. That trust is fragile, and when Shopify’s checkout ignores it, everyone feels the cracks: finance loses control, sales lose momentum, and buyers lose confidence.

The answer isn’t more spreadsheets, more approvals buried in inboxes, or more awkward phone calls. It’s building credit into the portal itself—automating the limits, approvals, and balances that already define how B2B really works.

With a credit engine inside Shopify Plus, orders flow until they shouldn’t. Approvals trigger exactly when they must. Balances stay visible to both sides. Buyers stop second-guessing, finance stops firefighting, and sales stop apologizing. What used to be a liability becomes a competitive edge.

Because in the end, credit isn’t back-office. It’s the backbone of how relationships are built and how contracts are kept. Get it wrong, and you erode trust. Get it right, and you give buyers the confidence to keep placing orders—bigger, faster, and more often.

If you’re still managing credit on spreadsheets or patching it with manual workarounds, you’re carrying more risk than you realize. The smart move is to take control before the cracks widen.

Contact us, and we will help your current AR process, show where the gaps are exposing you to risk, and design a credit management system inside Shopify Plus that enforces rules automatically. No more blind exposure. No more stalled orders. Just a portal that matches the way industrial trade actually works.