If you have an eCommerce company, there’s a good chance that you’ve had to deal with chargebacks at some point since you’ve been in business.

In fact, the average rate of merchant chargebacks across all industries is rising 20% every year.

The first time you went through the chargeback process, you may not have realized exactly what was happening. In some instances, merchants might not even know that a chargeback has been issued until after it’s been completed.

That’s because there are systems in place to protect consumers. The chargeback process heavily favors cardholders.

Banks and credit card companies want their customers and cardholders to feel secure.

Consumer’s know that if they have a problem, they can take steps against an unreliable or shady retailer to protect their funds. This prevents eCommerce merchants from selling products or services that don’t meet the standards of the description.

Furthermore, chargebacks protect consumers against criminal fraud.

In the last five years, 46% of Americans have fallen victim to credit card fraud. So if your customers haven’t personally been affected by fraud, they probably know someone who has.

Cleary, the consumer is protected by chargebacks. But what about eCommerce businesses?

Unfortunately, your company won’t have as much luck. Consumers are guilty of committing “friendly fraud,” which occurs when they file a chargeback for the wrong reason.

In fact, studies show that 80% of consumers filed a chargeback because they didn’t have enough time to contact the merchant for a refund.

That’s why 80% of merchants dispute some chargebacks that they believe are illegitimate.

However, this is a losing battle. Only 18% of merchants report that they win more than 60% of their disputes against friendly fraud.

Disputing chargebacks is not the solution. That was my inspiration for writing this guide.

Instead, you need to learn how to avoid eCommerce chargebacks in the first place. In the event of a chargeback, there are other ways to deal with the situation.

Anyone with an eCommerce business will benefit from this guide. It will save you time, money, and headaches in the long-run. Here’s what you need to know.

Pick a Good Processor and Great Merchant Account

The first thing you need to do is make sure you have a good processor and merchant account.

You need to have a great relationship with their merchant department. Make your selection based on finding a logical representative, so you can communicate with them in the event of a problem.

As the name implies, payment processors handle all of the payment processing services used by eCommerce retailers.

They typically have partnerships with other companies that deal with consumers and retailers, such as credit card companies like Visa and Mastercard.

Not all payment processors offer merchant services. Authorize.net providers usually suck.

When it comes to something so important for your business, finding the cheapest available option isn’t necessarily the best choice.

If it sounds like you’re currently using a bad processor, I would highly recommend looking into alternative options moving forward.

Consider switching to a processor like Stripe or Paypal.

The reason why I recommend using a payment processor like Stripe is because their merchant support is much better than their competitors. Stripe’s pricing is also very transparent. They charge flat rates that are competitive with other processors in the industry.

Check Each Transaction

Checking each transaction needs to part of your eCommerce protocol.

By checking these transactions, it will help you identify potential fraud, which would ultimately result in a chargeback.

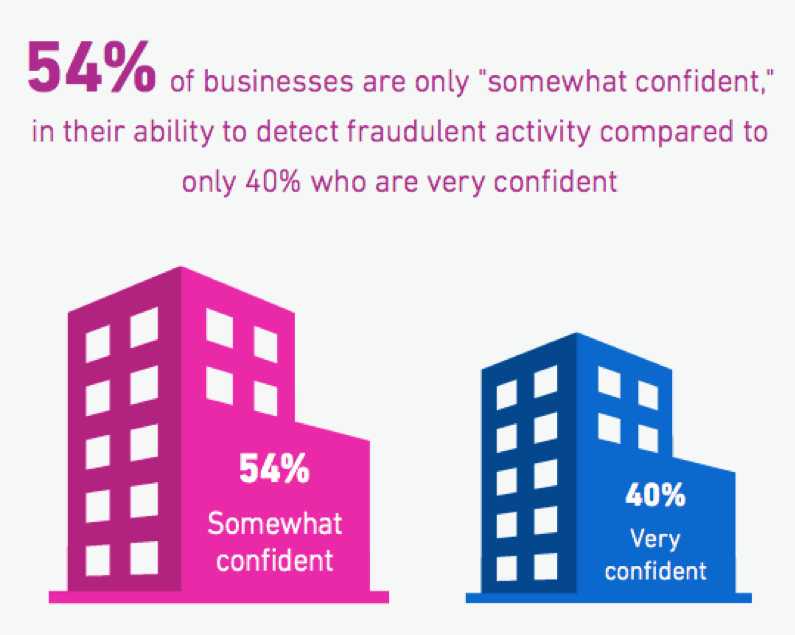

According to the 2018 Experian Fraud Report, only 40% of businesses say that they are very confident in their ability to detect fraudulent activity.

Furthermore, 45% of business executives say that they have a growing concern about the risk of fraud.

One of the best ways to check transactions is with AVS, also known as an address verification system.

Rather than just asking for a credit card number, you should also ask for the billing address of the associated card. Your AVS will verify that this address matches the card and help you eliminate fraud.

For example, let’s say someone loses a credit card. If that card falls into the hands of a criminal, they could use the card to make online purchases from eCommerce shops that don’t have an address verification system.

This type of security measure isn’t just used for online processing. Think about the last time you filled your car with gas. Lots of gas stations require a zip code to process payments directly from the pump.

Watch the average order volume as well. The key is to eliminate as many potentially chargebacks as possible.

If your percentage of complaints as high, the terms of the situation won’t matter.

The processor will just look at the percentage of chargebacks and automatically assume that the services rendered were poor. So if you have an internal customer satisfaction issue, I would look into that.

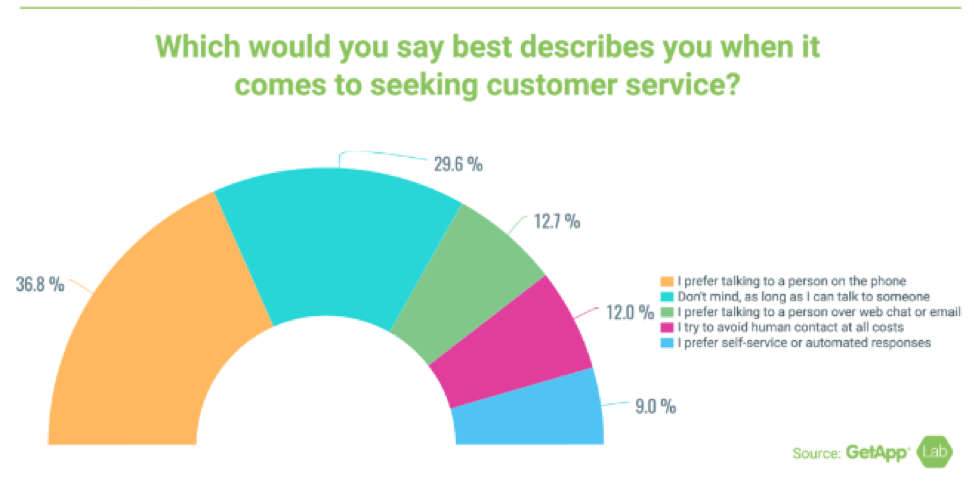

Give your customers as many options as possible when it comes to seeking customer service.

Earlier I explained that a large percentage of consumers file chargebacks because they think it’s easier than contacting the merchant directly.

You need to take steps to make sure that this never happens to your company.

Make it as easy as possible for customers to reach you.

- Phone

- Live Chat

- Social media

Since people have different preferences, you need to accommodate all of their needs. Your customer service team needs to be readily available on multiple platforms to help the consumer.

Make Sure Your Product is High Quality and as Advertised

This should go without saying, but you would be surprised how often I encounter retailers who sell products that are different than what they advertise.

Let me clarify what I mean. I’m not saying that they claim to be selling a backpack and then sell the customer a wallet instead.

But they do things like claim their backpack is durable, waterproof, and made from the strongest materials in the world. Then, the bag arrives with zippers falling off and gets ruined the first time it’s exposed to the rain.

In addition to being unethical, this is just bad business practice.

If a customer feels like they’ve been lied to or scammed, they won’t hesitate to file a chargeback.

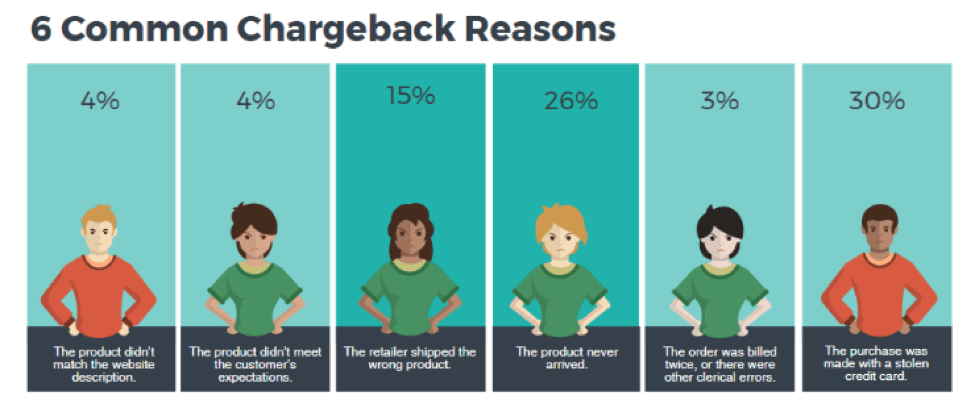

As you can see from the data above, customers file chargebacks for a number of reasons.

- The product didn’t match website description

- The product didn’t meet expectations

- Wrong product delivered

- Product never arrived

- Billing errors

- Fraud

By prioritizing quality and making sure that you know how to write eCommerce product descriptions are accurate, you can eliminate the possibility of chargebacks due to those reasons.

In fact, if you have a great processor and do the things that we’ve already discussed in this guide, you can eliminate more than half of the common reasons for chargebacks on this list.

Ship on Time

People hate receiving their stuff late.

If your company is promising items to be delivered by a certain time, you better make sure that you follow through with that promise.

I get it. Sometimes things happen that are out of your control. If there is a winter blizzard that shuts down roads across the country, you can’t help it if there is a delay in shipping.

But in this case, the customer needs to be contacted right away to let them know about the changes. Otherwise, you risk getting a chargeback filed. So set up advanced customer notifications and alerts.

When an order doesn’t arrive on time, customers might be worried that they were scammed, especially if your business isn’t well-known and they’ve never bought anything from you before.

If a customer orders something from Apple or Nike, they’ll probably be comfortable knowing that those businesses didn’t just take their money and run. But if your eCommerce brand is new or unknown, consumers won’t feel as comfortable if their order isn’t delivered on time.

43% of consumers in the United States say they expect businesses to offer faster delivery times. This number is up from 35% in 2017.

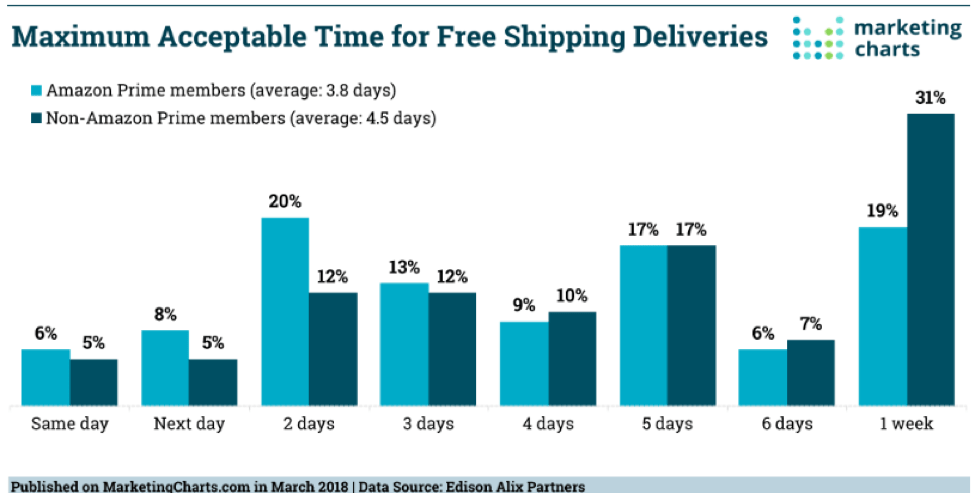

With big players like Amazon offering 2-day shipping for so many items on their website, people are used to receiving eCommerce orders faster than ever before.

That’s why the average acceptable time for free shipping deliveries is lower for consumers who have Amazon Prime accounts.

Don’t promise a delivery date that you can’t keep.

If the customer receives a product that was delivered on time and meets the description that they saw online, it will help reduce the risk of a chargeback being filed.

Types of Chargebacks and Chargeback Dispute Process

There are different instances when businesses are at risk for chargebacks.

Depending on the type of company you have, you may be vulnerable for one or more of these instances. I’ll briefly explain each scenario below.

eCommerce

eCommerce chargebacks are pretty straightforward. The majority of what we discussed so far in this guide relates to this instance.

It’s estimated that the eCommerce industry suffers from a $6.7 billion total annual loss in revenue due to chargebacks. This number is continuing to rise each year.

As an eCommerce brand, you need to be aware of this and take steps in the right direction to limit your company’s vulnerability in the future.

Event

There are times when your business might host or attend events. In these cases, customers would pay for services rendered at the event.

However, if customers aren’t satisfied with their experience, it could result in them filing a chargeback. So make sure you do whatever you can to prevent this from happening.

When the event is over, put customer service representatives at the exit to be readily available to listen to any complaints from attendees.

Give them peace of mind, small gifts, or potentially even refunds if they’re not happy. It’s better for you to handle refunds directly, as opposed to getting a chargeback.

Make sure your website has a very obvious customer support page for people to access when they get home after attending the event. Here’s a great example of a support page from Choice Screening.

Take complaints very seriously. Address them right away. Call the customers to hear what they didn’t like or why they didn’t see a value in the event.

There might be an issue here that cannot be resolved with a new processor or lawyer. Don’t waste your time or money contacting a lawyer. They can’t help you with chargebacks.

Retail

Some of you might have physical brick and mortar locations in addition to your eCommerce platform.

Just because something is bought in person, it doesn’t mean that those transactions are immune to chargebacks.

There are steps you can take to prevent fraud at your retail locations as well.

Ask customers to provide a photo ID when paying with credit cards. This will prevent people from using a stolen card when making a purchase.

Be careful when taking phone orders. Instead, encourage those callers to visit your eCommerce site or come to your store. If you’re going to take phone orders, use an address verification system, which we previously discussed.

Make sure your credit card processing equipment is up to date and compatible with chip software. Otherwise, customers can file a chargeback claiming their card wasn’t present at the time of a purchase. Although this would be fraudulent and unethical from the customer, it’s still possible.

What to do if You Are Getting Too Many Chargeback Claims

Some of you might be going through this guide and identifying areas that you can improve to prevent eCommerce chargebacks.

However, it’s possible that a handful of you have taken the proper steps and you’re still having a problem with getting too many chargebacks. How could this be happening?

If everything is great with your operation and the issue is with your customers, then it’s possible that you’re attracting the wrong crowd for some reason. There are people out there who will do whatever they can to get something for free, even if it means being dishonest.

You want to make sure that your brand isn’t targeting this type of audience. Analyze your eCommerce content marketing strategy and make the necessary adjustments.

Look at your product complaints as well as your customer support. Read online reviews about your brand from third-party sites. This will help you identify common problems.

Consider the possibility of fraud. Ship with signature confirmation to the billing address.

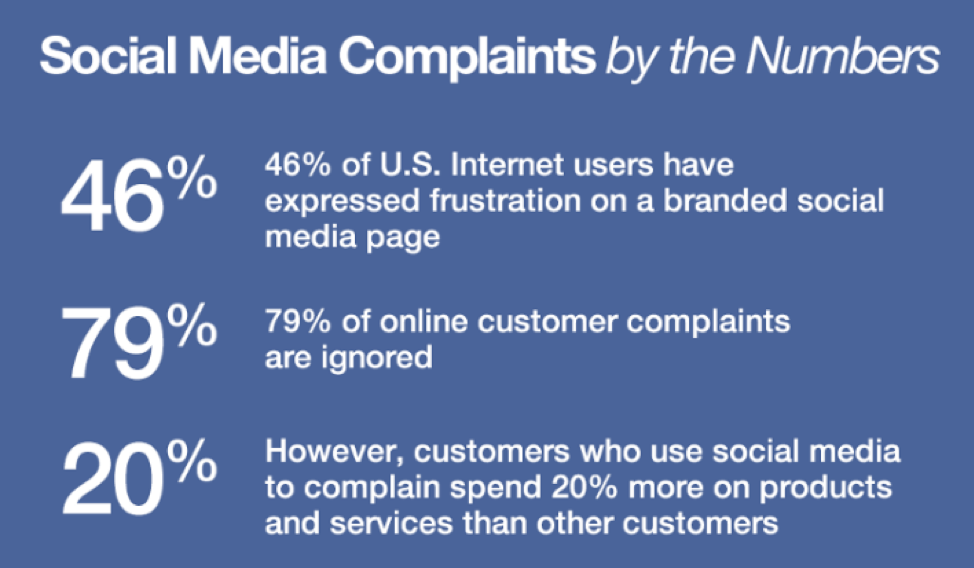

Look at all of your channels for placing orders. You may notice that social media platforms have higher complaints.

Nearly 80% of customers who complain on social media get ignored.

That’s terrible. Your business has no excuse for doing this.

You could prevent chargebacks by reaching out to these customers who complain on social media. If they don’t hear from you after complaining, they’ll escalate the scenario by contacting their credit card company or bank.

Functionality to Avoid Chargebacks

Sometimes, you need to implement changes to your website and process to handle chargebacks the right way.

These are the functionalities you can use to avoid chargebacks or respond to chargebacks.

Post Checkout Notices

Set expectations with custom post checkout messages.

Tell users the charge on their statement will read “ABC Company.” If your customer doesn’t recognize the name of a company on their credit card statement, it could be why they disputed a charge.

Let them know exactly when their order will be arriving by, which we discussed earlier. Don’t promise shipping deadlines that you can’t meet.

Automated Follow-up Emails

You should also send follow-up emails to your customers after they receive their orders.

These messages should contain satisfaction surveys. A customer may be hesitant to go out of their way to let you know if they aren’t satisfied. However, if you open the door and make this easier for them, they’ll let you know how they feel.

Address unhappy customers ASAP.

Resolve the problem with the customer before they have a chance to file a chargeback.

Website Ticketing / Support System

Your site should have an easy to access the ticketing system.

This will be used for customers to submit complaints or other issues.

You’ll want this system to be part of your customer support page, which I briefly talked about earlier. Let customers know that a service representative will contact them about their problems ASAP.

Automated RMA System

RMA stands for return merchandise authorization.

You need to set up a system for users to easily return products. If a customer feels like they can’t return something they bought from your site, it could prompt them to start the chargeback process.

Don’t make returns be a burden for your customers.

So do things like offer automated return labels as a standard part of your service.

Fraud Metric System

According to a recent study, the cost of fraud is roughly 2% of the total annual revenue for retail and B2B industries.

2% may not seem too high at first glance but consider your revenue. If you did $1 million in sales, this will cost you $20,000. That’s far from a marginal amount of money.

A fraud metric system will help you determine the likeliness that an order is fraudulent or has a high chargeback rating.

This could be orders that are shipped to different addresses, located in various states, have extremely high prices, or anything else that would be considered a red flag.

Managing Chargebacks

Chargebacks are becoming a growing problem for the eCommerce industry, but that doesn’t mean that your eCommerce business needs to suffer.

There are plenty of ways for you to appropriately deal with and prevent eCommerce chargebacks. Just use this guide as a reference to implement the necessary changes.

Here at Optimum7, we have developed our own algorithm to determine fraud and chargeback metrics.

Our algorithm can be integrated with any online system. So inquire here if you would like to learn more.

Don’t let chargebacks hurt your reputation and cost you money. Start taking preventative measures today.