The Business

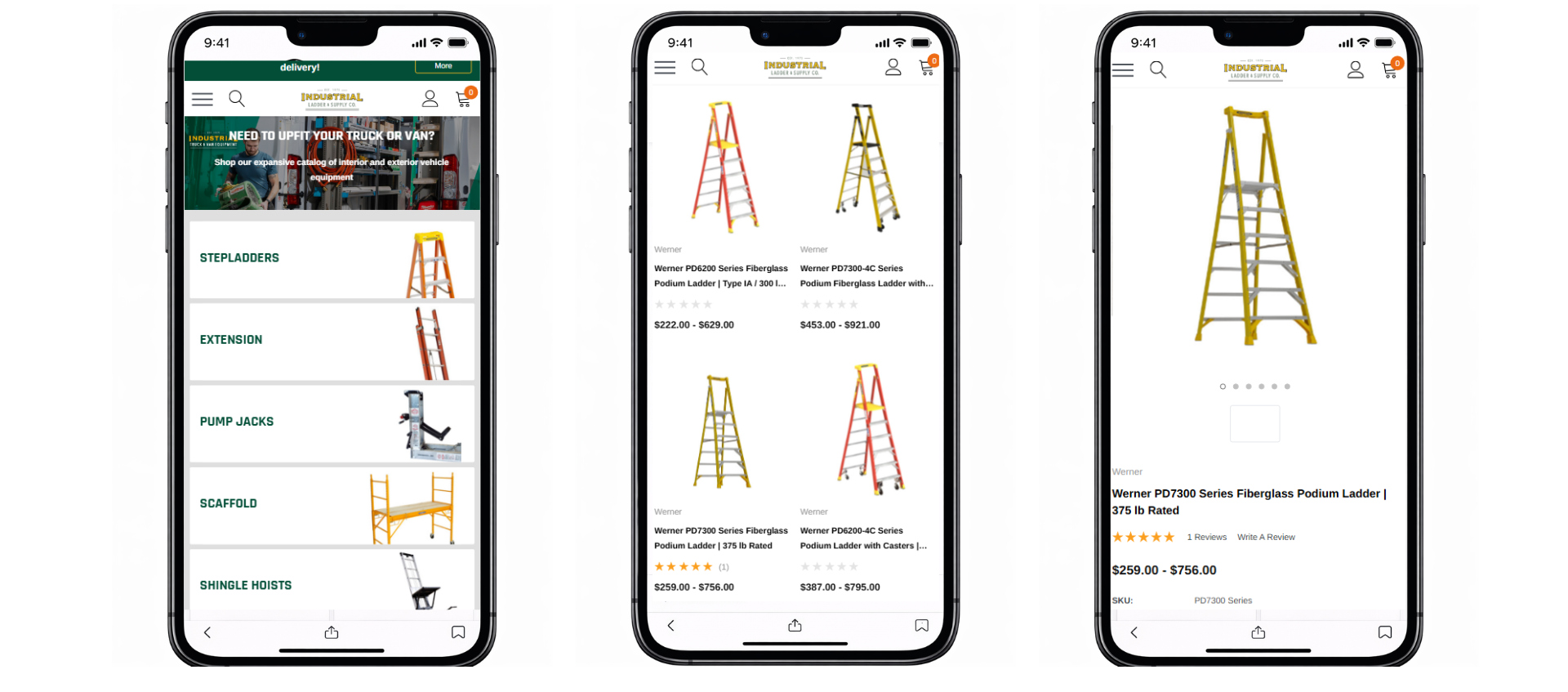

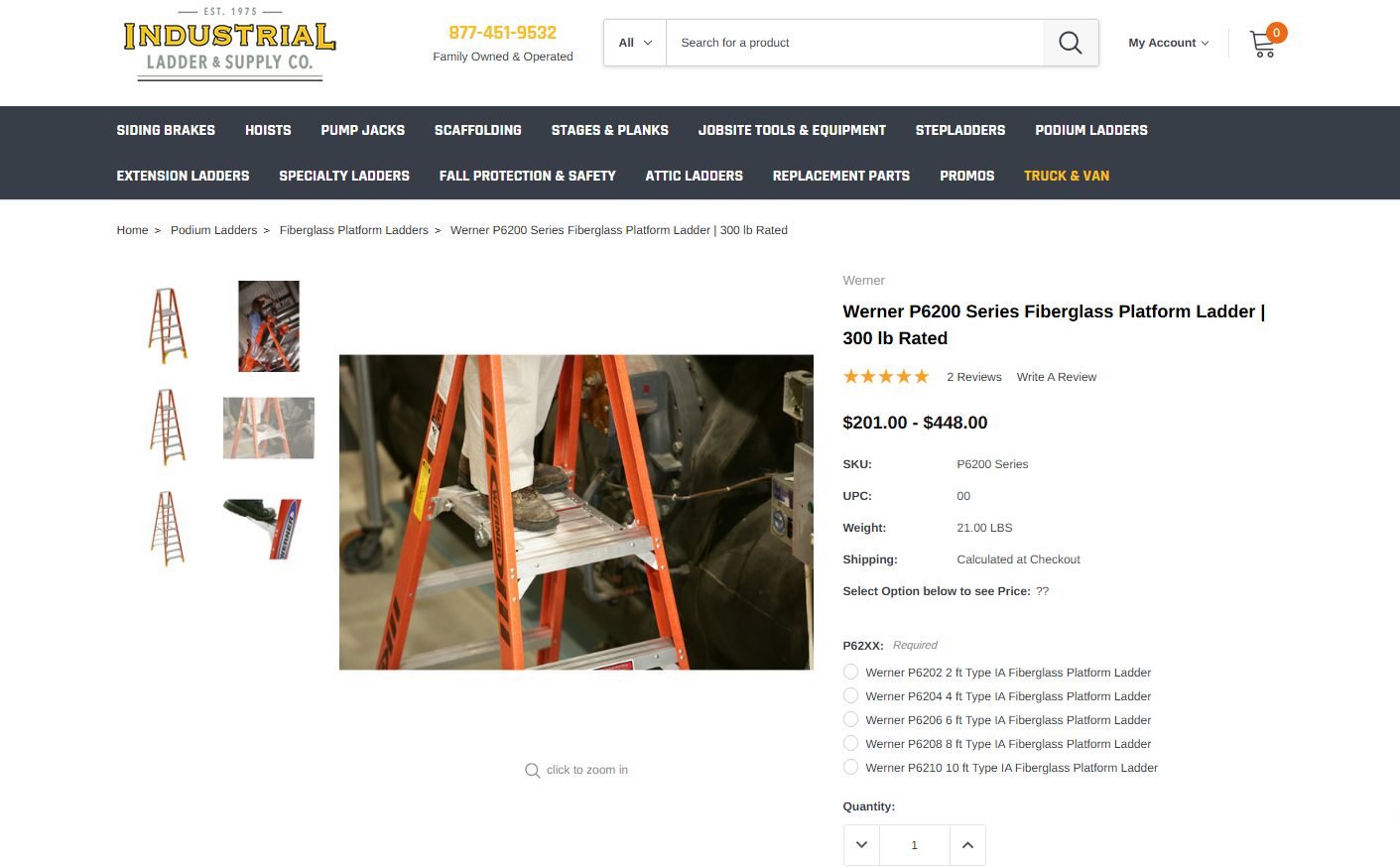

IndustrialLadder.com serves contractors, roofing crews, maintenance teams, and industrial facilities that buy with accuracy in mind. Their customers are not casually browsing; they are sourcing equipment that needs to match exact requirements, meet jobsite standards, and show up when it is needed. When a crew needs a replacement part for a ladder rack or a contractor requires a specific platform configuration, delays cost more than convenience.

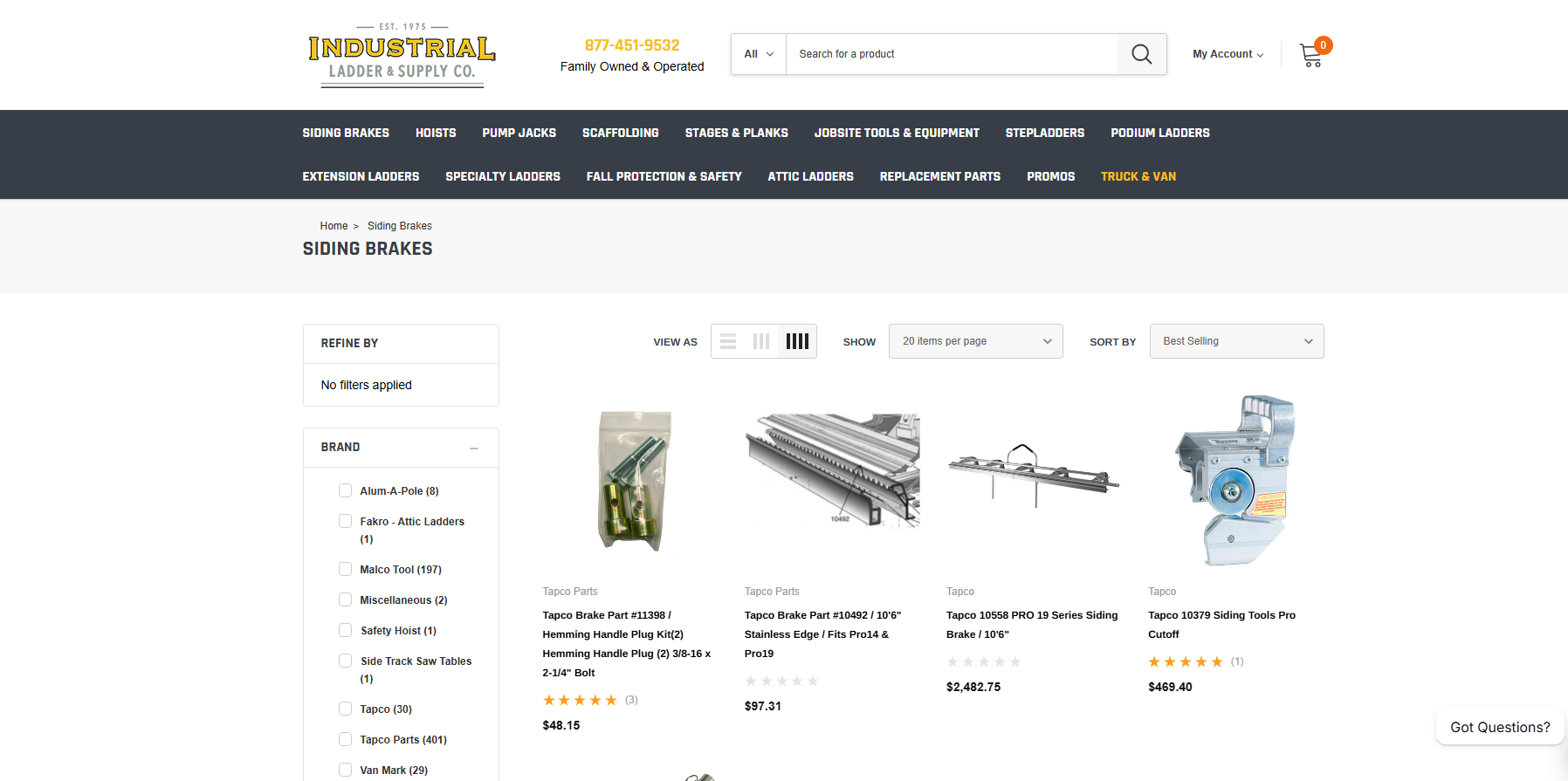

The company built its reputation around having the right inventory when others do not. From Werner and System One to Knaack and Tapco, Industrial Ladder carries specialized SKUs that big-box retailers often overlook. Hard-to-find parts, niche configurations, and brand-specific replacements form a meaningful share of demand.

However, depth alone does not guarantee online performance.

National competitors such as Home Depot and Grainger invest aggressively in search and paid acquisition. Construction cycles fluctuate. Replacement-part queries are fragmented and long-tail heavy. To compete consistently, Industrial Ladder needed more than traffic. It needed a durable search authority, a clean technical structure, and a conversion path that captured high-intent demand instead of letting it slip away.

Optimum7 came into the picture at this point.